Choosing the Right iGaming Payment Gateway: A Complete Operator Guide

Jan 5, 2026

Fluid

Guide for Malta iGaming operators to choose gateways that meet MGA, PSD2, AML and GDPR while preventing fraud and improving player experience.

Payment gateways are the backbone of iGaming platforms. They directly affect player satisfaction, compliance, and revenue. For Malta-based operators, the stakes are higher due to strict Malta Gaming Authority (MGA) regulations and EU payment laws. Here’s what you need to know:

Compliance is mandatory: Your gateway must meet MGA standards, PSD2 (Strong Customer Authentication), AML, and GDPR requirements.

Speed and security matter: Players expect instant deposits and quick withdrawals, alongside robust fraud prevention.

Localisation is key: Support for euro (€), local payment methods, and regional preferences enhances player trust.

Fraud prevention: Real-time monitoring, behavioural analytics, and tools like tokenisation reduce risks.

Player experience drives loyalty: Mobile-friendly interfaces, clear error messages, and fast processing improve satisfaction.

Scalability and analytics: A gateway should grow with your business and provide data-driven insights to optimise performance.

Operators must balance regulatory compliance, technical performance, and player experience to succeed in Malta’s competitive iGaming market. The right payment gateway ensures smooth operations, builds trust, and boosts player retention.

How iGaming Operators Should Choose the Right Payment Provider

Payment Gateway Requirements for Malta-Based iGaming Operators

iGaming platforms operating out of Malta must meet stringent technical and regulatory standards when it comes to payment gateways. These aren't just suggestions - they're mandatory to retain your licence and provide a secure, seamless experience for players. The Malta Gaming Authority (MGA) enforces strict rules on handling player funds, verifying identities, and monitoring transactions, placing your payment gateway at the heart of compliance.

Compliance and Security Standards

Your payment gateway must align with MGA licensing requirements from the start. A key feature is player fund segregation, which ensures player funds are routed into separate accounts automatically. These systems must also create audit trails that track every movement of funds. Without this, you risk breaching regulations, which could lead to licence suspension.

The Payment Services Directive 2 (PSD2) introduces Strong Customer Authentication (SCA), affecting how deposits are made. For most transactions above €30.00, two-factor authentication is mandatory. Your gateway must support these protocols while keeping the process smooth. If authentication takes too long, players may abandon their deposits.

Striking the right balance between security and user experience is key. Some gateways enforce SCA for every transaction, frustrating players with frequent small deposits. A better approach is transaction risk analysis, which applies SCA only when necessary, exempting low-risk transactions where regulations allow. This method keeps the process secure while avoiding unnecessary friction for trusted users.

Compliance also involves embedding AML (Anti-Money Laundering) and KYC (Know Your Customer) tools into your payment system. Your gateway should flag suspicious activity, such as structuring (multiple small deposits to avoid detection), quick deposit-and-withdrawal cycles, or transactions originating from high-risk regions. Detailed compliance reports must document flagged transactions and actions taken. Automated reporting tools can streamline this process and reduce errors.

Another critical standard is PCI DSS Level 1 certification, the highest level of payment card security. This involves annual audits and constant monitoring. While your gateway provider handles most of this, you must ensure your integration doesn't create vulnerabilities. Sensitive card data should never be stored on your servers; instead, use tokenisation to secure information.

Once compliance is in place, focus shifts to fraud prevention.

Fraud Prevention and Transaction Security

Fraud prevention is essential for protecting your players and your business. The iGaming industry is a frequent target for fraudulent activities, from stolen card testing to bonus exploitation. Your payment gateway should have real-time fraud detection, analysing data points like device fingerprints, IP addresses, transaction patterns, and geolocation.

Fraud detection works best in layers. The first layer screens for obvious issues like mismatched billing addresses or transactions from flagged IP addresses. The second layer dives deeper, analysing player behaviour for unusual patterns such as sudden changes in deposit methods or attempts to withdraw funds to different accounts.

Chargeback management is another critical area. Clear transaction descriptors - such as your brand name and relevant details - help players recognise payments on their statements, reducing disputes. When chargebacks occur, your gateway should quickly gather evidence like transaction logs, player communications, and proof of service delivery to dispute illegitimate claims effectively.

Tokenisation is a must for securing saved card details. By replacing card numbers with random tokens, even if the data is compromised, it remains useless to attackers. This also eases PCI compliance requirements.

For additional security, 3D Secure 2 enhances card transaction authentication. Unlike its predecessor, which disrupted every transaction with redirects, 3D Secure 2 uses risk-based authentication to challenge only high-risk transactions. This keeps the process smooth for most players while maintaining robust security.

Velocity controls are another useful tool. These set limits on deposits or withdrawals, such as "no more than three deposits per hour" or "a maximum of €500.00 in deposits within 24 hours for new accounts." These controls protect against both fraud and excessive gambling.

Localisation for Maltese and EU Players

Beyond compliance, tailoring your payment gateway to the preferences of Maltese and EU players enhances engagement. Multi-currency support is essential, with the euro (€) as the primary currency. Players in the eurozone expect transactions without conversion fees or hidden markups. Your gateway should process euro transactions through European acquiring banks to keep fees and processing times low.

For non-eurozone players, support for their local currencies - such as British pounds, Swedish kronor, or Polish złoty - is crucial. Be transparent with exchange rates and avoid hidden fees. Some gateways offer dynamic currency conversion, allowing players to choose between euros and their home currency.

Local payment methods are also critical. For example:

Dutch players favour iDEAL.

Germans often use Giropay or Sofortüberweisung.

Nordic players prefer Trustly for bank payments.

E-wallets are popular across Europe, but preferences vary by region. Your gateway should integrate with multiple e-wallet providers, offering fast transaction settlements and lower chargeback risks.

Attention to detail matters. Use European date formats (DD/MM/YYYY) and the 24-hour clock (e.g., 14:30). Number formatting should follow the European standard, such as €1,000.50, with commas for thousands and full stops for decimals. These conventions ensure clarity and professionalism.

Language support goes beyond translation. Use terminology that resonates with players in specific regions. For instance, British players might prefer "top up" over "deposit." Error messages should be clear, concise, and written in natural language for each supported region.

Finally, integrate responsible gambling tools into your payment system. Players should be able to set deposit limits - daily, weekly, or monthly - and your gateway must enforce these limits. If a player attempts to exceed their set limits, the transaction should be blocked. These controls are required by the MGA and are essential for promoting safe gambling practices.

Assessing Payment Gateway Features for iGaming

Once you've addressed compliance and security, the next step is to evaluate payment methods, transaction speed, and deposit flow to ensure a seamless experience for players.

Payment Methods and Transaction Features

The range of payment methods your gateway supports plays a key role in attracting and retaining players. Given that preferences across Europe vary by region, offering diverse options can help maximise revenue.

Card payments: Supporting major networks like Visa and Mastercard is non-negotiable. These are essential for both credit and debit transactions, though acceptance rates can differ substantially between providers.

SEPAtransfers: A mainstay for eurozone operations, SEPA bank transfers cater to players who prefer not to use cards or e-wallets. SEPA Instant Transfers allow for quick deposits, while standard SEPA transfers are better suited for withdrawals due to their longer processing times.

E-wallets: These are popular across many European markets, but no single e-wallet dominates everywhere. Integrating multiple e-wallet providers ensures broader coverage. E-wallet deposits are processed almost instantly, and withdrawals are typically completed within hours. Additionally, the pre-loading requirement adds an extra layer of verification, reducing chargeback risks.

Bank transfers: Services that connect directly to a player's online banking offer enhanced security and fast verification. These combine the reliability of traditional bank payments with the speed of e-wallets.

Cryptocurrency: If your licence permits crypto transactions, consider gateways that can convert digital currencies to fiat quickly. While mainstream adoption remains limited, its relevance is growing in regions with favourable regulations.

Multi-currency wallets: These allow players to maintain balances in their preferred currency, avoiding repeated conversion fees. For instance, a player in the UK might hold a balance in pounds sterling, only converting to other currencies when necessary and under clear terms.

Tokenisation for recurring payments: By storing card data as tokens, this feature allows players to make secure, repeat deposits with ease.

Once you've selected the right payment methods, it's time to focus on transaction speed and user experience - both of which significantly impact player satisfaction and conversion rates.

Transaction Speed, User Experience, and Conversion

After meeting security and compliance requirements, the focus shifts to optimising transaction speed and user experience. Players expect deposits to be instant so they can start playing without delay, while quick withdrawals help build trust and keep them engaged.

Instant deposits: These improve conversion rates by reducing the time spent on authorisation and fraud checks.

Fast withdrawals: Offering near-instant withdrawals can set your platform apart. Modern systems that use real-time verification - checking player identity, account status, and available balance - can significantly shorten processing times compared to traditional batch-based methods.

Mobile optimisation: With mobile gaming on the rise, responsive payment flows are essential. Features like simplified forms and mobile-friendly options (e.g., Apple Pay or Google Pay) enhance engagement. Showing the most relevant payment methods based on the user's device also improves the overall experience.

Streamlined checkout: A single-page checkout with pre-filled information and quick-select deposit options can reduce friction and minimise drop-offs.

Effective error handling: Clear, actionable error messages can prevent frustration. For example, instead of a vague "Transaction failed", a message that suggests trying a different method or contacting the bank is far more helpful.

Bonus integration: If a deposit qualifies for a bonus, your payment system should allocate it immediately, ensuring players see the bonus in their account right away.

Responsible gambling limits: Payment systems should respect deposit limits set by players. Real-time tracking of deposits ensures no transactions exceed these limits, with clear feedback provided when a restriction is triggered.

These features not only enhance the player experience but also improve operational efficiency, leading to higher conversion rates and repeat engagement.

Payment Method Comparison: Speed, Fees, and Adoption

Here's a comparison of common payment methods to help you weigh their advantages and limitations:

Payment Method | Deposits | Withdrawals | Fees | EU Adoption | Chargeback Risk |

|---|---|---|---|---|---|

Credit/Debit Cards | Fast processing | Typically processed over business days | Generally higher | Very popular | Relatively high |

E-wallets | Very fast | Usually fast | Moderate | Widely used | Very low |

SEPA Instant Transfers | Nearly instant | Nearly instant | Low, predictable | Moderately popular | Very low |

Standard Bank Transfers | Processed in business days | Processed in business days | Variable | Moderately used | Low |

Instant Bank Transfers | Rapid processing | Typically fast | Moderate | Popular in certain regions | Low |

Cryptocurrency | Fast after confirmations | Varies with network conditions | Often lower (subject to network fees) | Niche adoption | None |

While credit and debit cards remain the most widely used, they come with higher fees and an increased risk of chargebacks. For high-volume operations, these costs can eat into margins, especially when factoring in the expenses associated with managing chargebacks. Balancing these factors is crucial for optimising profitability.

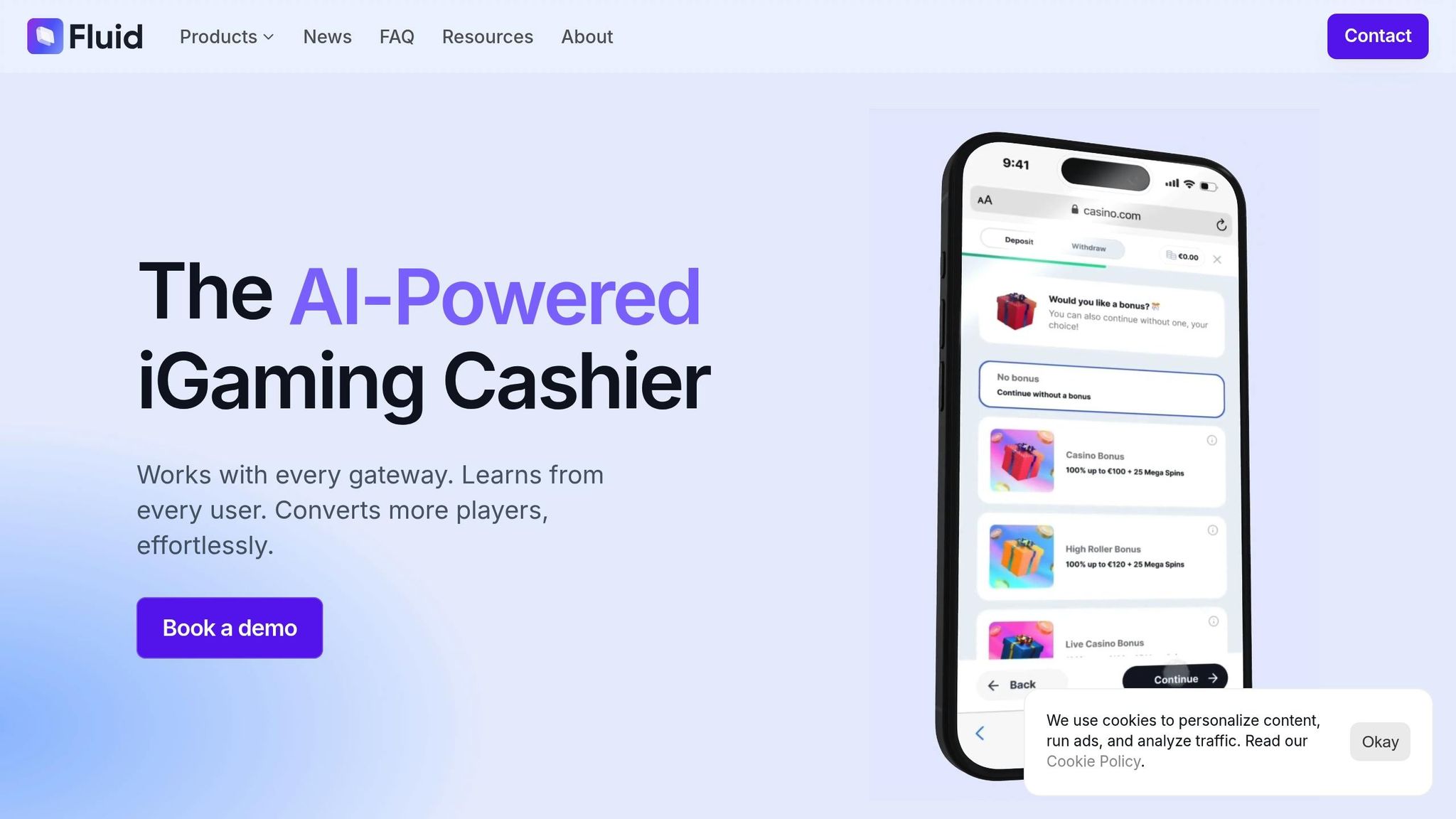

Fluid: AI-Powered Payment Solution for iGaming Operators

Fluid offers tailored, AI-driven payment solutions designed specifically for iGaming operators based in Malta, combining convenience, security, and scalability.

Personalised Payment Journeys with Fluid

Fluid leverages AI to create a customised payment experience for each player. By analysing factors like location, device type, transaction history, and preferred payment methods in real time, it ensures players see the most relevant options. For example, a player in Malta using a smartphone would be presented with mobile-friendly payment methods and transaction amounts formatted to local standards.

The platform also provides clear, step-by-step instructions for each payment method while maintaining seamless integration with your brand’s look and feel. This ensures a consistent and user-friendly experience that aligns with your brand identity. Alongside this, Fluid’s personalised approach incorporates comprehensive security measures to protect your players.

AI-Powered Fraud Detection and Real-Time Analytics

Fraud is a persistent concern for iGaming operators, but Fluid tackles this challenge with advanced AI-driven security measures that identify threats without disrupting legitimate transactions. Key security features include:

Security Feature | Function | Benefit |

|---|---|---|

Biometric Authentication | Utilises native biometric checks | Offers strong yet effortless security |

Real-time Monitoring | Continuously tracks user actions | Flags suspicious behaviour promptly |

AI Risk Assessment | Evaluates multiple security factors | Dynamically adjusts security measures |

Behavioural Analytics | Monitors user interaction patterns | Detects anomalies with precision |

Fluid’s system learns typical player behaviours - such as preferred payment methods, average deposit amounts, and transaction habits - to identify irregularities. Real-time monitoring combined with adaptive risk assessment ensures operators receive actionable insights through an analytics dashboard, enabling them to fine-tune payment processes and enhance fraud prevention strategies.

Integration and Scalability with Fluid

Fluid is designed for quick, hassle-free integration, requiring minimal development effort. Its intuitive APIs and mobile-first design ensure smooth performance across all devices, delivering a consistent and engaging experience for users.

The platform is built to scale, accommodating diverse transaction volumes. Whether you’re running a boutique casino or a large operation, Fluid grows with your business. As you expand into new markets, the platform’s support for multiple currencies and cryptocurrencies simplifies the process, eliminating the need for significant infrastructure changes. Flexible pricing across Basic, Pro, and Enterprise plans means you only pay for the features and transaction volumes that suit your needs, making it a cost-effective solution for operations of any size.

Implementation and Optimisation for Malta-Based Operators

Setting up a payment gateway in Malta is no small task. It requires careful planning, precise technical work, and strict adherence to regulations. Here's a guide to help operators integrate and optimise their systems effectively.

Payment Gateway Integration Best Practices

Before jumping into integration, review your current systems thoroughly. Your development team needs a clear understanding of how the payment gateway will interact with your player management system, accounting software, and compliance-monitoring tools. This preparation helps avoid delays and ensures that data flows smoothly across all platforms.

When testing, use sandbox environments and start with common scenarios like deposits and withdrawals. Gradually move to edge cases, documenting each test for future Malta Gaming Authority (MGA) audits.

For Malta-based operators, Euro reconciliation is a key consideration. Always use European number formatting (commas for thousands, full stops for decimals) and set up automated reconciliation processes. This ensures your payment gateway records align with your accounting system daily. Any discrepancies should trigger immediate alerts, as unexplained differences can create compliance issues during MGA reviews.

Another crucial step is recording transaction data from day one. Capture and securely store details like timestamps (DD/MM/YYYY HH:MM), player IDs, amounts, payment methods, and approval codes. This data must be accessible for at least five years in auditor-friendly formats. Automated reporting tools can simplify this by generating compliance-ready summaries on demand.

When launching, start small. Roll out the system to a limited group of users, monitor transaction success rates and support tickets, and expand gradually. This phased approach helps ensure technical stability and keeps players happy.

Improving Payment KPIs with Fluid

Fluid's AI-powered analytics can provide Malta-based operators with actionable insights that directly impact performance. While the platform tracks numerous metrics, focus on the ones that matter most: conversion rates, fraud detection, and player satisfaction.

Improving conversion rates starts by identifying where players drop off during the payment process. Fluid’s real-time analytics pinpoint the exact step - whether it’s payment method selection, authentication, or final confirmation. For many operators, issues often stem from mobile-unfriendly payment methods or overly complex verification processes. Use AI-driven suggestions to streamline these areas without compromising security.

Fraud detection is another area where Fluid shines. The platform uses behavioural analytics to establish normal activity patterns for each player, such as typical deposit amounts and preferred payment methods. If a transaction deviates significantly from these patterns, it’s flagged for review without being immediately blocked. This approach balances fraud prevention with a smooth player experience.

Player satisfaction is closely tied to the quality of their payment experience. Fluid tracks metrics like deposit and withdrawal times, failed transactions, and payment-related support requests. Set benchmarks for these metrics and review them weekly. If satisfaction scores drop, investigate immediately - payment issues can drive players to competitors faster than almost anything else.

Regular optimisation sessions are essential. Schedule monthly reviews of Fluid’s analytics to identify trends and make improvements. Small tweaks, like shaving a few seconds off payment completion times, can lead to noticeable gains in conversion rates over time.

Staying Current with Regulatory Changes

Keeping up with Malta’s regulatory requirements is just as important as optimising performance. The MGA frequently updates its rules, and staying compliant requires vigilance.

Monitor official channels like MGA notifications and compliance bulletins. Assign someone on your team to track these updates and assess their impact on your payment systems. A compliance calendar can help you stay organised, noting when new regulations take effect and what changes are needed.

EU regulations also play a big role. Directives like PSD2 (Strong Customer Authentication), 5AMLD (anti-money laundering), and GDPR (data protection) apply to iGaming transactions. Your payment gateway must handle these requirements seamlessly, so staying informed about EU-level changes is critical.

When regulations change, update your documentation immediately. Review your payment policies, terms and conditions, and player-facing information to ensure compliance. Train your staff on new procedures and use platforms like Fluid to adjust payment flows and verification processes without major redevelopment.

Proactive compliance is always better than last-minute fixes. If regulatory changes are being discussed, start planning your response early. This gives you time to test new processes, train your team, and inform players about what to expect. It also shows regulators that you’re taking compliance seriously.

Finally, conduct regular compliance audits. Quarterly internal reviews can catch issues before regulators do. Examine transaction records, player verification processes, and payment practices against current MGA standards. Document these audits and any corrective actions. For an extra layer of assurance, consider hiring external compliance consultants annually - they can offer fresh insights and spot problems your team might miss.

Conclusion: Selecting the Right Payment Gateway for iGaming

Picking the right payment gateway is a critical choice that directly influences your iGaming business. It impacts everything from player satisfaction to meeting legal requirements, making it a core element of your operations.

Here’s a quick rundown of what matters most:

Security and compliance: Your gateway must automatically adhere to essential regulations like MGA standards, PSD2, AML, and GDPR. These are non-negotiable for protecting your business and maintaining trust.

Player experience: A smooth, user-friendly payment process is key to turning visitors into paying players. A slow or complicated system can undo all your marketing efforts. Focus on optimising mobile usability and simplifying transactions to keep conversions high.

Real-time analytics: Access to instant data helps you act fast when conversion rates dip, fraud risks emerge, or certain payment methods underperform. For operators in Malta, native Euro support and familiar European formats also help build trust and stay compliant.

Scalability: As your business grows, your payment gateway needs to grow with it. Solutions like Fluid offer quick integration, full customisation, and the ability to scale seamlessly.

The iGaming industry is constantly evolving, with new payment methods, stricter regulations, and increasing player expectations. Your gateway must keep up. Features like AI-driven personalisation, real-time fraud detection, and automated conversion optimisation ensure you stay competitive in this dynamic landscape.

FAQs

What are the compliance standards for iGaming payment gateways in Malta, and how can operators ensure they meet them?

In Malta, iGaming payment gateways are required to meet strict regulations established by the Malta Gaming Authority (MGA) and the Financial Intelligence Analysis Unit (FIAU). These regulations demand top-notch payment security, compliance with anti-money laundering (AML) laws, and support for transactions in multiple currencies, including the euro (€).

To stay compliant, operators must prioritise robust fraud prevention systems, carry out regular audits, and keep detailed records as mandated by local authorities. Partnering with a payment gateway that meets these regulatory standards and integrates smoothly with your platform is an important step in ensuring both compliance and operational efficiency.

How can iGaming operators ensure top-notch security while keeping the payment process smooth and user-friendly?

iGaming operators can strike the perfect balance between robust security and a smooth user experience by using advanced fraud detection systems. These systems work quietly in the background, safeguarding sensitive player information without interrupting the payment process. This ensures transactions remain both secure and hassle-free.

On top of that, providing reliable and localised payment options that align with players' preferences - like accepting the euro (€) and offering familiar payment methods - can boost both trust and convenience. A simple, user-friendly payment interface further reduces any barriers, making it easier for players to complete their transactions with confidence.

What localisation features are essential in a payment gateway to build trust and improve player satisfaction in Malta and the EU?

To strengthen trust and boost player satisfaction in Malta and across the EU, a payment gateway must focus on multi-currency support, enabling smooth transactions in euros (€) with accurate formatting (e.g., €1,234.56). It's equally important to follow local standards, such as the DD/MM/YYYY date format, while using British English spelling to meet cultural preferences.

On top of that, complying with EU regulations, ensuring secure and swift transactions, and offering support for local payment methods can significantly improve the user experience and build confidence among players.