How to Design Payment Flows for Global Users

Jun 11, 2025

Fluid

Learn how to design payment flows that cater to global users by understanding regional preferences, compliance, and security essentials.

Localisation is critical: Payment preferences vary by region. For example, credit cards dominate in North America, while mobile wallets thrive in Asia-Pacific. In Malta, 70% prefer electronic payments like BOV Pay or PayPal.

Dynamic payment options: Use geo-location and user data to display relevant payment methods. Tailoring options reduces cart abandonment and increases conversions.

Compliance matters: Adhere to local regulations like GDPR, VAT rules, and AML requirements to avoid penalties and build trust. In Malta, VAT rates range from 0% to 18%, depending on the service.

Secure transactions: Use encryption, tokenisation, and fraud detection tools to protect sensitive data. Multi-factor authentication can further enhance security.

Mobile-first design: Simplify payment flows for smaller screens with thumb-friendly layouts, clear progress indicators, and AI-powered recommendations.

Quick Comparison of Regional Payment Preferences

Region | Preferred Payment Methods | Key Statistics |

|---|---|---|

North America | Credit cards, Affirm (BNPL) | 58% of eCommerce transactions via credit cards |

Europe | Digital wallets, SEPA transfers | Strong SCA compliance required |

Asia-Pacific | Mobile wallets, Alipay, WeChat | 311% growth in mobile wallet users by 2025 |

Malta | BOV Pay, PayPal, electronic | 70% prefer electronic payments, 13% prefer cash |

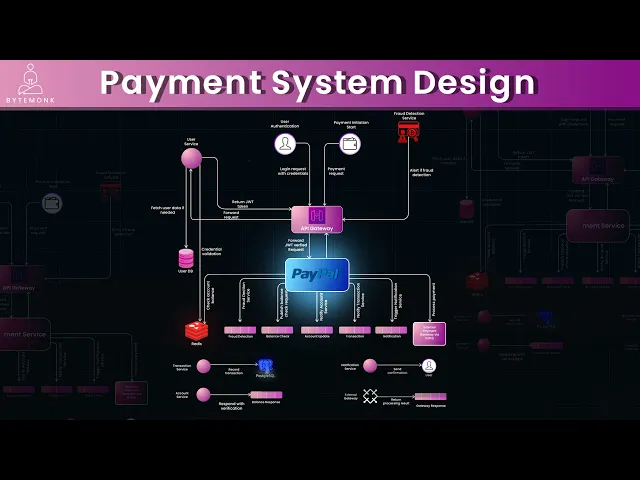

System Design Global Payment Processing | Paypal

Understanding Regional Payment Preferences

Payment habits differ significantly across regions, meaning a payment method that thrives in one market might flop in another. With the value of cross-border payments projected to exceed $250 trillion by 2027, understanding these regional preferences is essential. Let’s dive into how to identify local payment favourites, adapt dynamically to user needs, and account for behavioural differences to create smoother payment experiences.

Mapping Local Payment Methods

The first step is figuring out which payment methods dominate in your target regions. For instance, in North America, credit cards are king, making up 58% of all eCommerce transactions, according to J.P. Morgan. On the other hand, digital wallets are gaining traction across Europe and the Asia-Pacific regions.

In Malta, 70% of consumers prefer electronic payments, while only 13% still lean on cash. Popular options include BOV Pay, Gozo Credit Union, and PayPal. Generational differences are evident too - older Maltese consumers tend to favour cash more than younger ones.

Emerging markets showcase even more dramatic shifts. In Southeast Asia, mobile wallets are booming, with Bloomberg predicting a 311% surge in users from 2020 to nearly 440 million by 2025. Globally, mobile payments hit nearly $1 trillion in spending in 2022.

Region | Preferred Payment Methods | Key Statistics |

|---|---|---|

North America | Credit cards, Affirm (BNPL) | 58% of eCommerce transactions via credit cards |

Europe | Digital wallets, SEPA transfers, Klarna | Strong SCA compliance required |

Asia-Pacific | Mobile wallets, WeChat Pay, Alipay | 311% growth in mobile wallet users by 2025 |

Malta | Electronic payments, BOV Pay, PayPal | 70% prefer electronic, 13% prefer cash |

Once these local preferences are mapped out, the next step is to display the most relevant options dynamically for each user.

Dynamic Payment Method Prioritisation

Geo-location and user data can be game-changers when it comes to tailoring payment options. By showing users the payment methods they’re most familiar with, you can boost conversions and reduce checkout friction.

For example, consider factors like where your customers are located, their past payment behaviours, and direct feedback when deciding which methods to highlight. Analysing existing payment data can also uncover regional trends, helping you refine the checkout experience. The goal? To make payments feel seamless and intuitive, no matter where your users are.

Addressing Regional and Behavioural Differences

Cultural nuances heavily influence payment preferences. For instance, in Malta, surveys show that convenience and safety are the main reasons people choose certain payment methods. Trust also plays a role - some regions stick with well-established local banks, while others are more open to newer fintech providers. The pandemic accelerated digital payment adoption worldwide, but the pace of change varies from place to place.

Understanding these behavioural patterns allows you to design payment flows that feel natural to users in different markets. Take Buy Now, Pay Later (BNPL) as an example: Klarna is a leader in Europe and the UK, Afterpay dominates in Australia and New Zealand, and Affirm is a popular choice in North America. By tailoring payment options to regional and demographic preferences, you can minimise friction and create a more user-friendly global payment experience.

Implementing Localised Payment Experiences

Tailoring payment processes to align with local norms - like currency displays, tax rules, and language preferences - is key to creating a seamless checkout experience. These customisations not only meet customer expectations but can also boost conversion rates. To fully localise, focus on technical elements such as currency formatting, tax compliance, and language settings.

Currency Formatting and Conversion

Make sure to follow local currency conventions. For instance, in Malta, display amounts in euros as €1,234.56.

Leverage APIs for multi-currency processing to enable dynamic conversions, lock exchange rates, and automate hedging. This ensures payments are processed using up-to-date rates. Real-world example: An e-commerce platform saw a 30% boost in international sales after integrating a multi-currency payment gateway. The ability to accept multiple currencies can significantly increase sales, especially as global payment volumes are projected to grow from $190 trillion in 2023 to $290 trillion by 2030. Once your currency setup is in place, ensure tax calculations are compliant with local regulations.

Tax and VAT Compliance

Adhering to VAT rules is critical for legal and financial stability. This includes proper collection, reporting, and remittance of VAT. Non-compliance can lead to penalties, making it a priority in localised payment flows.

In Malta, the standard VAT rate is 18%, with reduced rates of 7% and 5% for specific goods and services. For digital services, the VAT rate depends on the customer’s location. Non-resident companies must register for VAT regardless of annual turnover, while resident companies face thresholds of €35,000 per year for goods and €30,000 for services.

VAT Rate | Type | Applicable Goods/Services |

|---|---|---|

18% | Standard | All other taxable goods and services |

7% | Reduced | Hotel accommodation; sporting facilities |

5% | Reduced | Medical equipment for disabled; books; newspapers; cultural events |

0% | Zero | Food for human consumption; prescribed medicines; gold ingots |

Collect customer details like addresses and tax IDs to automatically calculate and apply the correct VAT. For B2B transactions, validate VAT numbers. Ensure invoices comply with local standards, including business details, customer information, VAT numbers, service descriptions, and applicable VAT rates. In Malta, VAT returns must be submitted within one month and 15 days of the end of the reporting period, and records should be kept for at least six years.

Date, Time, and Language Localisation

Language and format preferences play a huge role in user experience. Studies show that 75% of users prefer content in their native language, and 40% of customers won’t purchase from websites in a foreign language.

In Malta, dates follow the DD/MM/YYYY format, and time is displayed using the 24-hour clock typical in Europe.

PayPal’s 'Language Experts Program' demonstrates how professional localisation can improve engagement and reduce translation errors. For technical implementation, libraries like moment.js or date-fns can dynamically adjust date and time formats. Allow extra space for text expansion in languages like German or Russian - 20–30% more room for text fields, buttons, and labels is recommended. Notably, 56% of consumers are more likely to buy if content is in their preferred dialect. Companies that A/B test localisation efforts have reported conversion rate increases of up to 49%.

When localising payment flows, translate not just button text but also error messages, confirmation screens, and descriptions of payment methods. Use CSS logical properties for layouts to accommodate both left-to-right and right-to-left languages. Always test your localised designs with native speakers to ensure they resonate and are culturally appropriate.

Ensuring Compliance and Security Across Borders

Gaining the trust of global users hinges on adhering to strict compliance and security measures that align with both local and international standards. Cross-border payments are under heavy regulatory scrutiny, with over 6,000 new sanctions introduced in 2023 alone. The stakes are high - according to a 2022 Deloitte report, non-compliance with Anti-Money Laundering (AML) regulations led to $5 billion in fines for credit and financial institutions.

KYC and AML Integration

Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations serve as the foundation for secure payment systems. These measures are critical in preventing money laundering, fraud, and terrorist financing within the payments ecosystem. Alarmingly, global money laundering activities are estimated to reach up to $2 trillion annually.

A risk-based approach to KYC verification is essential. High-risk customers should undergo enhanced due diligence (EDD), while lower-risk users can follow simplified procedures. Ongoing monitoring is key, as customer details and behaviour can evolve over time. Screening customers against sanctions lists, Politically Exposed Persons (PEP) databases, and adverse media during onboarding, rescreening, and transactions is non-negotiable.

For Malta-based businesses, compliance with the EU's Anti-Money Laundering Authority (AMLA) regulations is mandatory. These rules standardise AML efforts across EU member states. Additionally, the Financial Action Task Force (FATF) has implemented stricter KYC requirements for virtual asset service providers. Automating AML processes can help minimise human errors, while appointing dedicated compliance officers ensures teams stay updated on changing regulations. Once compliance is established, the next priority is securing payment data.

Payment and Data Security

After verifying customer identities, the focus shifts to protecting payment data throughout the transaction process.

Payment security is critical for maintaining customer trust and business continuity. In 2021, 71% of businesses reported experiencing payment fraud attempts. Meanwhile, the global average cost of a data breach reached €4.88 million in 2024. For businesses in Malta handling payments in euros, breaches can be particularly costly due to strict GDPR requirements.

Start by conducting a thorough risk assessment to pinpoint vulnerabilities in your payment system. Employ layered security measures like encryption, tokenisation, and advanced access controls. End-to-end encryption (E2EE) ensures data is secure from the moment payment details are entered until the transaction is completed. Multi-factor authentication (MFA) adds an extra layer of protection, while role-based access control (RBAC) limits access to sensitive payment data to authorised personnel only .

AI-powered fraud detection tools can analyse payment activity in real time, flagging suspicious transactions immediately. However, regulators are increasingly scrutinising AI-driven compliance tools to ensure they are transparent and unbiased. Adherence to PCI DSS standards is a must for businesses handling credit card information. Strengthen your security framework further by training employees, implementing a patch-management policy, and testing updates in controlled environments . Secure payment gateways with built-in encryption, tokenisation, and continuous monitoring provide an additional layer of defence.

Cross-Border Payment Infrastructure

Once compliance and security are in place, the focus turns to building a robust cross-border payment system.

Handling cross-border payments requires balancing efficiency with compliance across various jurisdictions. For operations within the Eurozone, integrating SEPA Instant Credit Transfer enables instant euro payments across participating countries, reducing settlement times and improving cash flow for merchants and customers. Using multiple acquirers can boost acceptance rates by up to 16%, compared to relying on a single acquirer. Diversifying payment processors across regions also ensures service continuity and reduces dependency risks.

Data governance introduces unique challenges, as regulations in one country can impact payment services in another. The Financial Stability Board is working on recommendations to improve alignment and interoperability between these frameworks. Conducting due diligence on third-party service providers is critical to ensure GDPR compliance. Additionally, having an incident response plan in place allows businesses to address data breaches swiftly. Stay updated on regulatory developments and adjust data transfer practices as needed.

"Navigating the intricacies of cross-border payments begins with a thorough understanding of the compliance processes that underpin successful international business dealings." - AIPrise

Partnering with technology providers that offer tools for automating compliance processes can significantly reduce errors. This is especially important for Malta-based businesses expanding into markets with diverse regulatory landscapes. Automated systems are often more adaptable than manual processes, making them a valuable asset. Monitoring regulatory updates in real time ensures long-term compliance and operational success.

Optimising for Mobile-First Payment Journeys

As mobile devices continue to dominate the payment landscape, optimising payment journeys for smaller screens has become essential. Around 69% of smartphone users prefer sending money via apps rather than websites, and 76% feel their payment app experiences could be much better. This highlights a clear opportunity for businesses: focusing on mobile-first payment design can lead to higher user satisfaction and better conversion rates. The key lies in understanding how users interact with mobile devices and tailoring designs to meet their expectations.

Mobile-Responsive Design

Crafting mobile-friendly payment experiences starts with addressing the realities of smaller screens. It's no surprise that 80% of mobile payment users prioritise ease and convenience, which translates into specific design principles.

Thumb-friendly layouts: Buttons should be easy to tap (minimum size 44×44 pixels), and single-column forms should be used to avoid horizontal scrolling.

Simplified forms: Arrange fields in a logical order, starting with simple details (e.g., an email address) before asking for more complex information, such as payment card numbers. This approach reduces user drop-off.

Progress indicators: Showing users where they are in the process improves clarity, and immediate error messages help them correct mistakes without frustration.

The importance of visual hierarchy can't be overstated. Payment method icons should be prominent, required fields clearly marked, and contextual help readily accessible without overwhelming the interface. As the GoCardless content team puts it:

"There is one golden rule of payment UX: make it easy for your customer to do what you want them to do." - The GoCardless content team

AI-Powered Payment Recommendations

Artificial intelligence is reshaping mobile payment journeys by offering personalised recommendations based on factors like user behaviour, device type, and location. With the global digital payments market expected to hit $16.6 trillion by 2028, growing annually at 14.8%, AI is becoming a game-changer. For example, users who frequently pay via credit card might see card options first, while those favouring instant payments could be shown digital wallets.

AI also enables real-time credit assessments, making Buy Now, Pay Later options more accessible with tailored repayment plans. For users in Malta handling euro transactions, this could mean flexible schedules for larger payments or reminders for recurring bills.

The iGaming sector offers a glimpse into how AI can elevate payment experiences. Platforms like Fluid's AI-powered digital cashier analyse user behaviour to create tailored payment journeys. This not only boosts conversion rates but also provides operators with real-time insights, ensuring each user gets options suited to their preferences.

AI's ability to adapt payment flows dynamically is another advantage. If a user tends to abandon transactions when faced with too many choices, the system can streamline options to focus on what’s most relevant. These insights contribute to more localised and seamless mobile payment experiences, particularly in regions like Malta.

Streamlining Mobile Payments in Malta

Adapting mobile payment systems for Malta requires attention to local standards and preferences. This includes currency formats, banking integrations, and compliance with Maltese conventions.

Currency formatting: Euro amounts should follow the Maltese style, with the currency symbol placed before a space (e.g., € 1,000.00), using commas for thousands and periods for decimals.

IBAN validation: Automatically verifying Malta’s IBANs ensures smoother transactions.

Postal code integration: Auto-complete features should recognise Malta’s three-letter postal codes, such as MST for Mosta, ZBR for Żebbuġ, or GZR for Għajnsielem in Gozo, to populate town and district details.

While traditional payment methods like cash and cards remain popular, mobile payments are gaining traction. Services like Google Pay and Apple Pay are available in Malta, though some merchants may set minimum spend limits.

Other localisation efforts include using the DD/MM/YYYY date format (e.g., "04/05/2025") to avoid confusion and adhering to British English spelling conventions, such as "licence" instead of "license."

Biometric authentication is also on the rise in Malta, with features like fingerprint and facial recognition simplifying payment approvals and eliminating the need for complex passwords. Coupled with 24/7 customer support and easy-to-follow tutorials, these features ensure users can navigate payment processes smoothly and resolve issues quickly.

Conclusion: Designing Payment Flows That Work Globally

To create payment flows that truly resonate across global markets, businesses need to strike a balance between localisation, compliance, and user-focused design. Research shows that improving checkout design and flow can boost conversion rates by up to 35% on average, while adding personalised elements to the checkout process can lead to a 20% increase in sales. On the flip side, nearly 40% of customers abandon their carts when faced with irrelevant or overwhelming options. This highlights the importance of crafting a payment journey that aligns with user behaviour and regional expectations.

"If a deposit fails or their preferred payment method isn't available, they'll leave and go elsewhere. Operators are spending significant money to acquire users - so every friction point matters."

Localisation plays a key role in tailoring the checkout experience to match local preferences, habits, and legal requirements. For businesses operating out of Malta, this means adhering to regional standards and formats, as previously discussed. With the global business-to-consumer cross-border ecommerce market projected to hit $7.9 trillion by 2030, the stakes for getting localisation right are higher than ever.

AI-powered tools are also transforming payment flows, offering businesses the ability to adapt quickly to user behaviour while ensuring secure transactions. These technologies help merchants analyse data in real time, detect potential threats, and automate identity verification - all while staying compliant with regulations. In fact, over 70% of financial services companies now use machine learning to predict cash flow, detect fraud, and assess credit scores. A noteworthy example comes from February 2025, when Canadian operator PowerPlay integrated Fluid's AI-powered cashier technology. CEO Dean Serrao emphasised how this upgrade provided players with a faster, more intuitive, and locally tailored payment experience while improving operational efficiency.

Mobile-first payment solutions are equally critical, as 74% of financial institutions report that their corporate clients struggle with managing supplier payments. This underscores the need for mobile payment systems that not only meet global compliance standards but also deliver smooth, user-friendly experiences.

In the iGaming space, platforms like Fluid showcase how AI-driven digital cashiers can personalise payment processes, enhance conversion rates, and offer real-time insights into user behaviour. Features like advanced fraud detection, seamless brand integration, and optimised user flows contribute to secure, efficient payment experiences that work effortlessly across borders.

The key to building globally effective payment flows lies in four pillars: localisation, compliance, AI-driven enhancements, and mobile-first design. Businesses that master these elements will not only meet user expectations but also drive growth, ensuring payment experiences that are both seamless and secure.

FAQs

How can businesses comply with local regulations when creating global payment flows?

Navigating Local Regulations in Global Payment Flows

When designing global payment systems, businesses need to prioritise understanding the legal requirements of each region they operate in. This means complying with laws like Anti-Money Laundering (AML), Know Your Customer (KYC), and data protection regulations such as the General Data Protection Regulation (GDPR) in the EU. Keeping up with these regulations is crucial to minimise compliance risks.

Working closely with local regulatory bodies or seeking advice from compliance experts can offer insights into regional legal landscapes. Beyond this, having strong internal policies, conducting regular audits, and staying ahead of regulatory updates are key steps to maintaining compliance. These efforts not only mitigate legal risks but also build trust with users worldwide, including those in Malta, where transparency and security are particularly important.

How can I customise payment options to suit different regions?

To tailor payment options effectively for different regions, consider these key factors:

Regional payment preferences: Payment habits vary greatly across the globe. For instance, in Europe, many users lean towards methods like SOFORT or direct bank transfers. Meanwhile, in Asia, mobile wallets such as Alipay are widely used. Offering these options not only builds trust but also enhances user satisfaction.

Local currency pricing: Displaying prices in the local currency (e.g., €50.00 in Malta) removes uncertainty around exchange rates and hidden fees. This simple adjustment can significantly reduce cart abandonment rates.

Language and cultural tweaks: Adjusting the user interface to reflect local language, date formats (e.g., 31/12/2023), and number formats (e.g., 1,000.50) creates a more intuitive and familiar shopping experience.

By focusing on these aspects, businesses can streamline the payment process, boosting both conversion rates and customer happiness.

How does AI improve security and personalise payment experiences for users?

AI technology is transforming payment experiences by making them safer and more tailored to individual needs. With real-time fraud detection, AI can quickly spot and block unauthorised transactions, offering a stronger layer of protection for users' financial data. This not only keeps transactions secure but also helps build trust in the payment process.

On top of that, AI takes personalisation to the next level by analysing user behaviour and preferences. This allows it to suggest payment options that feel more intuitive and aligned with what users want, creating a smoother and more user-friendly experience. By blending security with personalisation, AI doesn’t just safeguard transactions - it makes the entire payment journey more engaging and effortless.