The Business Case for Investing in Smarter Payment UX

Dec 18, 2025

Fluid

Enhancing payment UX is crucial for iGaming operators in Malta to boost player satisfaction, retention, and compliance with regulations.

Improving payment user experience (UX) is no longer optional for Malta's iGaming operators - it's essential for staying competitive. Players expect fast, secure, and personalised payment options, and any friction in the process can lead to lost revenue, abandoned transactions, and reduced player loyalty. Here's what you need to know:

Why It Matters: A smooth payment process directly boosts conversion rates, player satisfaction, and retention. It also reduces operational costs and ensures compliance with Malta Gaming Authority (MGA) regulations.

Key Challenges: Operators face hurdles like complex MGA compliance, limited payment options, mobile usability issues, fraud prevention, and currency conversion problems.

Solutions: AI-powered systems offer personalised payment journeys, real-time fraud detection, and multi-currency support. These tools simplify transactions, increase trust, and streamline compliance efforts.

Results: Operators who prioritise payment UX see higher deposits, fewer support issues, and stronger player retention.

Investing in smarter payment systems isn't just a technical upgrade - it's a competitive advantage in Malta's crowded iGaming market. Fixing clunky payment processes today can lead to better revenue and happier players tomorrow.

From UX to load times, devices to payments: A deep dive into localised player journey

Malta's Regulatory and Compliance Requirements

Malta has built its reputation as a leading iGaming hub on a solid regulatory foundation. The Malta Gaming Authority (MGA) requires operators to integrate essential compliance measures into their payment systems, covering everything from transaction monitoring to player verification. Understanding these requirements is crucial - not only to avoid penalties but also to create payment systems that are both secure and user-friendly. Below, we break down the key MGA rules and provide guidance on designing compliant payment flows.

MGA's Payment Regulations

The MGA has recently updated its payment regulations, urging operators to adopt more proactive strategies in crafting their payment systems. One critical requirement is implementing real-time monitoring to quickly identify unusual transaction patterns. Additionally, updated player verification protocols now mandate timely identity checks, especially for larger transactions, bolstering payment security.

The guidelines also stress the importance of offering multiple payment methods to meet transparency requirements. Operators must ensure clarity in fee structures, currency conversion rates, and processing times, providing players with all necessary information before they make a transaction.

Building Compliant Payment Flows

Designing payment systems that meet MGA standards while delivering a smooth user experience requires careful planning. By aligning regulatory needs with user-focused design, operators can achieve compliance and enhance player trust. Here are some key areas to focus on:

Currency Handling and Display: Ensure all values are presented clearly in the local currency format, leaving no room for confusion.

Anti-Money Laundering (AML) Measures: Integrate tools that assess transaction risks, helping to identify legitimate payments and flagging those that need further review.

Player Protection Features: Include safeguards like deposit limit tools, alerts for unusual spending, and connections to self-exclusion databases to promote responsible gaming.

Data Security: Collect only the data you need and protect it with industry-standard encryption and tokenisation to meet data protection requirements.

Audit and Reporting Systems: Maintain detailed logs of all transactions, both successful and unsuccessful, to ensure compliance and facilitate regulatory reviews.

Mobile-Friendly Compliance: With the rise of mobile gaming, ensure payment interfaces are consistent and secure across devices. Compliance disclosures and verification processes should be easily accessible on mobile platforms.

Business Benefits of Better Payment UX

When Malta's iGaming operators prioritise smarter payment experiences, they unlock clear advantages in revenue, player retention, and operational efficiency. These improvements not only enhance the player journey but also contribute to smoother business operations.

Higher Conversion Rates and Revenue

Payment friction can be a major revenue killer. Complicated checkouts, unclear fees, or lengthy verification steps often lead players to abandon their transactions. By simplifying payment processes, operators can boost conversion rates, directly increasing deposits and overall revenue.

For Malta's growing base of mobile gamers, optimising payment interfaces for smaller screens is a must. AI-powered payment systems can personalise the experience by highlighting a player's preferred methods and remembering successful transaction patterns. This level of customisation speeds up the process and makes it more user-friendly.

Transparency is key too. Clearly displaying currency information and avoiding hidden fees builds trust, while unclear costs can easily drive players to competitors.

Better Player Satisfaction and Retention

Trust is the foundation of player loyalty, and payment experiences play a big role in building that trust. A smooth, transparent payment process reassures players and encourages them to stick around.

When platforms remember details like a player's preferred payment method, typical deposit amounts, or even the times they usually transact, it shows a level of care that makes players feel valued. On the flip side, payment issues can frustrate players, pushing them to switch platforms. Those who enjoy hassle-free payments are more likely to stay loyal and remain active for longer. This trust and satisfaction naturally lead to stronger player retention.

Improved Operations and Fraud Prevention

A smarter payment UX doesn’t just benefit players - it also streamlines operations for Malta's iGaming companies. AI-driven fraud detection can spot suspicious activity in real time, blocking fraudulent transactions while allowing legitimate ones to proceed without delays.

Modern AI tools analyse a range of data points - like device fingerprinting, behaviour patterns, and transaction history - to ensure robust security without unnecessary roadblocks. Genuine transactions flow smoothly, freeing up teams to focus on areas like player engagement and business growth.

Automated payment processing also reduces the need for manual intervention while staying compliant with MGA standards. Routine approvals are handled by AI, with only complex cases flagged for review. Real-time analytics further enhance operations by tracking conversion rates, identifying popular payment methods, and highlighting trends. These insights allow operators to proactively refine their systems.

Compliance becomes less of a headache too. Automated reporting and audit trails ensure payment flows align with MGA regulations, cutting down on risks and administrative effort. Many operators in Malta have reported a noticeable drop in payment-related support tickets after adopting smarter payment systems, allowing customer service teams to focus on engaging with players rather than troubleshooting issues.

AI-Driven Payment Technologies and Fluid's Capabilities

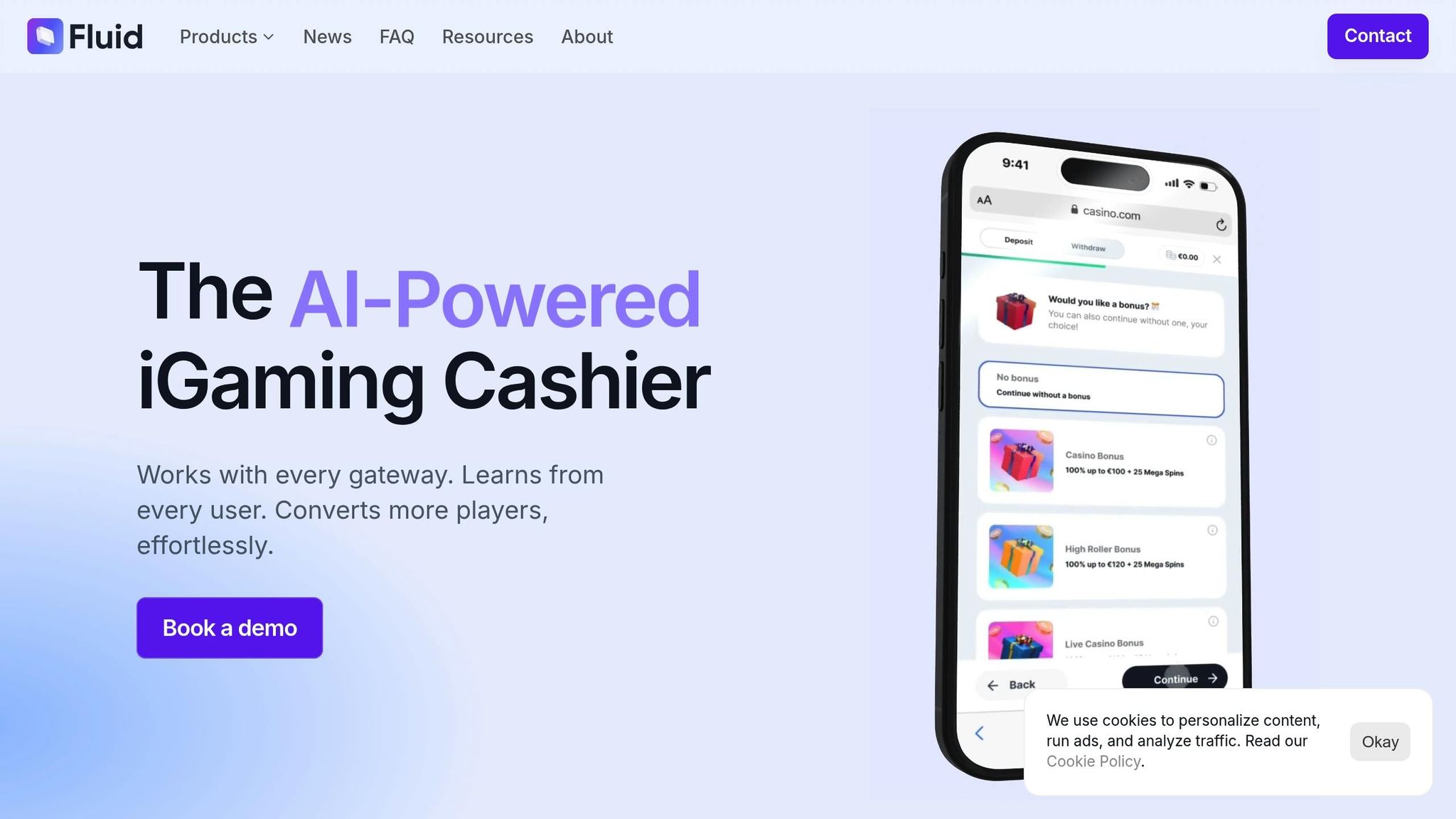

Artificial intelligence is reshaping how payment processing works for Malta's iGaming operators, making systems smarter and more responsive to player needs. By learning from user behaviour, predicting preferences, and simplifying transactions, these technologies reduce friction and improve conversion rates. Fluid takes full advantage of AI to craft personalised payment journeys, ensure real-time security, and maintain brand consistency, all while supporting multiple currencies.

AI-Personalised Payment Journeys

Fluid uses AI to tailor payment experiences by analysing player behaviour, transaction history, and preferences. For instance, when a player logs in to make a deposit, the system considers factors like their usual deposit amounts, preferred transaction times, and past payment successes. This ensures the most relevant options are presented first.

The personalisation goes beyond just offering options. Fluid’s AI adapts the entire payment process to suit each individual. Players aren’t forced through a one-size-fits-all flow; instead, the system adjusts verification steps based on their risk profiles and preferences. For high-risk profiles, verification may involve more rigorous checks, while low-risk users enjoy a smoother journey.

Real-time adjustments further refine the process. For complex payment methods, the system provides step-by-step guidance, while familiar transactions are kept straightforward. This smart approach reduces drop-offs and creates a seamless experience that feels custom-made for each player.

Real-Time Analytics and Fraud Prevention

Fluid’s AI doesn’t just personalise payments - it also strengthens security. By analysing player history, device fingerprinting, and transaction patterns, the system can detect fraud instantly without disrupting legitimate transactions. Device fingerprinting, for example, helps identify unusual activity, such as multiple accounts accessing from the same device or suspicious login patterns.

The platform’s real-time analytics give Malta’s operators valuable insights into payment performance. Operators can monitor conversion rates, identify popular payment methods for different player segments, and pinpoint issues in the payment flow. These insights allow operators to refine their strategies based on actual data, not guesswork, ensuring smoother processes and better results.

Brand Integration and Multi-Currency Support

Fluid also enhances the payment experience by keeping it consistent with the operator's brand. Instead of redirecting players to generic third-party payment pages, Fluid integrates branding throughout the entire process. This eliminates the disjointed iframe experience and keeps players engaged within the familiar look and feel of the platform, building trust and loyalty.

For Malta’s diverse iGaming audience, multi-currency support is a must. Fluid accommodates a wide range of currencies, from the euro (€) to cryptocurrencies, automatically recognising player preferences and displaying clear options. This flexibility ensures players from different regions enjoy a hassle-free experience.

The platform is designed with mobile users in mind, which is vital given the rise of mobile gaming in Malta. Its touch-friendly interfaces, responsive layouts, and simplified input methods ensure smooth payment flows across smartphones, tablets, and desktops.

What’s more, Fluid integrates seamlessly with existing systems via streamlined APIs. This means operators can enhance their payment capabilities without overhauling their infrastructure. The result? Faster implementation, reduced technical challenges, and immediate benefits for both players and operators. These advancements not only secure transactions but also drive efficiency and revenue growth.

How to Implement Better Payment UX: Practical Steps for Malta Operators

Improving payment user experience (UX) is an ongoing process. It involves evaluating current systems, making targeted improvements, and continuously refining the experience based on real-world data. Let’s break it down into actionable steps.

Evaluating Current Payment Systems

Before diving into changes, it’s essential to understand how your payment system is currently performing. Start by analysing key metrics to uncover potential pain points:

Look at conversion rates throughout the payment funnel to identify where users drop off.

Study average deposit values by payment method to find areas where friction might be occurring.

Track player behaviour to spot drop-off points during crucial steps like method selection, verification, or confirmation. These could signal issues with complexity or unclear design.

Examine churn metrics tied to payment processes to measure the impact of friction on user retention.

Test payment flows specifically on mobile devices. Problems that don’t appear on desktop might be glaringly obvious on a smaller screen.

Armed with these insights, you can move on to making targeted changes.

Steps to Implement Better Payment UX

Once you’ve identified the areas that need attention, a structured approach can help you improve the payment experience with minimal disruption. Here’s how:

Offer the Right Payment Options: Make sure your payment methods cater to Malta’s diverse audience, including European payment systems and traditional credit or debit cards.

Thoughtful Integration: Use Fluid's API-first approach to enhance your payment system without needing a complete overhaul. This approach works seamlessly with AI-powered personalisation and other advanced features.

Consistency is Key: Integrate payment flows into your platform while maintaining a consistent brand experience.

Prioritise Mobile Design: Start by optimising your payment process for smartphones, then adapt for larger screens. A mobile-first approach ensures a smoother experience for the majority of users.

Stay Compliant: Ensure compliance with Malta Gaming Authority (MGA) regulations at every stage of the improvement process.

Test Before You Commit: Roll out changes gradually and use A/B testing to identify which adjustments make the most impact.

Once these steps are in place, the focus shifts to monitoring and ongoing optimisation.

Monitoring and Ongoing Optimisation

To maintain a high-quality payment UX, continuous monitoring and regular updates are essential. Here’s how to keep things running smoothly:

Leverage Real-Time Data: Use Fluid's dashboard to track how changes influence player behaviour instantly.

Keep an Eye on Metrics: Focus on conversion rates, transaction values, and completion times. These numbers will help you fine-tune your strategy quickly.

Listen to Players: Post-transaction surveys can provide valuable insights that analytics might miss. Player feedback is a goldmine for identifying subtle issues.

Balance Security and Experience: While fraud prevention is crucial, make sure it doesn’t come at the expense of the user experience.

Adapt and Evolve: Regularly review your payment system to meet changing player expectations and market trends. Seasonal adjustments can also make a big difference.

Case Studies: Payment UX Results in Malta's iGaming Market

Real-world examples show how improving payment experiences can lead to noticeable benefits. Several iGaming operators based in Malta have achieved measurable success by refining their payment user experiences. Here’s a closer look at how these changes have driven revenue, ensured compliance, and strengthened player retention.

Revenue Growth Through Personalised Payment Journeys

A mid-sized casino operator in Malta faced challenges with low mobile conversion rates. To tackle this, they introduced AI-driven personalised payment journeys. These tailored experiences catered to players' preferred payment methods and offered customised guidance during transactions. The result? Deposit revenue increased, payment-related issues dropped, and deposits were completed faster. This shift not only improved the user experience but directly impacted the operator’s bottom line.

Compliance and Fraud Reduction Success Stories

Navigating Malta's rigorous regulatory landscape can be a hurdle for iGaming operators, especially with outdated payment systems. One operator relying on manual verification processes found that it slowed operations and left fraud detection reactive rather than proactive. By switching to an AI-powered payment system with real-time analytics, they transformed their compliance efforts. Automated checks reduced the need for manual reviews, fraud detection became more proactive, and regulatory reporting became quicker and less labor-intensive - all while staying fully compliant with the Malta Gaming Authority (MGA).

Player Retention and Satisfaction Improvements

Enhancing payment UX goes beyond meeting compliance - it can significantly boost player loyalty. A well-established Malta-based operator revamped its payment system using direct feedback from players. The updated system introduced multiple currency options, including cryptocurrency, and clear progress indicators during transactions. These changes not only improved satisfaction but also increased player retention. A smoother, more intuitive payment process led to more repeat deposits and fewer support requests related to payment issues. This ultimately contributed to a steady rise in revenue.

These examples highlight how smarter payment UX can deliver real results - higher conversion rates, better compliance, stronger fraud prevention, and happier players. For Malta's iGaming operators, investing in payment UX improvements isn't just a technical upgrade; it's a strategic move with tangible rewards.

Conclusion: The Business Case for Better Payment UX

Improving payment UX is a smart move for Malta's iGaming operators. Those who have enhanced their payment systems are already seeing tangible benefits like higher conversion rates, fewer fraud-related losses, and greater player lifetime value.

But the impact isn't just about boosting revenue - it also strengthens regulatory and operational processes. On the regulatory side, better payment UX helps operators in Malta meet MGA requirements more efficiently while cutting compliance costs. Features like automated verification and real-time monitoring replace labour-intensive manual tasks, making compliance smoother and freeing up resources for other priorities.

Beyond regulatory and operational advantages, a well-designed payment experience significantly improves player satisfaction and loyalty - a key reason to invest. In Malta's crowded iGaming market, players have plenty of choices. A clunky payment process can drive them straight to a competitor. On the other hand, a seamless and personalised payment experience builds trust, encouraging players to return and deposit again.

The good news? The tools to achieve this are already within reach. Solutions like Fluid, powered by AI, offer tailored payment journeys, easy brand integration, and advanced analytics - all tailored for the iGaming sector. With quick integration and a mobile-first approach, operators can see results fast without heavy development work.

For Malta's iGaming operators, the real question isn't whether to improve payment UX - it’s how soon you can make it happen. Payment UX isn't just a technical upgrade; it's a key competitive edge. Acting swiftly to enhance it can solidify your position in the market and keep you ahead of the competition.

FAQs

How do AI-powered payment systems improve the user experience for iGaming players in Malta?

AI-powered payment systems are transforming the iGaming experience for players in Malta by delivering faster, smarter, and more personalised payment options. These systems use advanced analytics to study player behaviour, allowing them to predict preferences and offer payment methods that match individual needs. The result? Transactions become smoother and less frustrating.

On top of that, AI-driven tools work tirelessly to detect and block fraudulent activities in real-time, creating a safer environment for players. They also automate compliance checks with Malta's local regulations, ensuring payments are processed efficiently and in line with legal requirements. This combination of speed, security, and personalisation makes payments not only reliable but also enhances the overall player experience, boosting satisfaction and loyalty.

What compliance requirements from the Malta Gaming Authority (MGA) should operators consider when enhancing payment UX in iGaming?

When refining the payment user experience (UX) in the iGaming industry, operators must prioritise compliance with Malta Gaming Authority (MGA) regulations. This includes meeting anti-money laundering (AML) and combating the financing of terrorism (CFT) requirements, ensuring secure and transparent payment processes, and protecting player data in line with GDPR guidelines.

Operators need to establish robust systems for verifying player identities (KYC) and monitoring transactions for unusual activity. Payment solutions should seamlessly handle euro (€) transactions, use clear, localised formatting, and provide precise reporting to fulfil MGA audit obligations. Aligning payment UX enhancements with these regulatory standards not only boosts player satisfaction and trust but also reinforces confidence in adhering to compliance requirements.

How can Malta's iGaming operators create payment systems that are user-friendly and meet regulatory requirements?

To create payment systems that are both easy to use and compliant with regulations, Malta's iGaming operators should focus on offering a variety of payment options. This could include local e-wallets, direct bank transfers, and solutions designed for the preferences of cross-border players. It's crucial to prioritise speed, reliability, and security, while also being transparent about transaction fees to build trust with players.

Staying up-to-date with regulations like PSD3 and AML/KYC requirements is equally important. Operators need to implement strong compliance measures without making the payment process cumbersome. Adding responsible gaming features not only strengthens trust but also ensures adherence to local guidelines. By addressing these key areas, operators can enhance player satisfaction and encourage long-term loyalty.