Tracking User Events for Payment Optimization

Aug 16, 2025

Fluid

Enhance payment optimization in iGaming with real-time user event tracking to boost conversions, improve user experience, and ensure compliance.

Want to improve payment experiences in iGaming? Here’s how:

Real-time user event tracking is the key to better payment flows. By understanding where players drop off during deposits, operators can fix bottlenecks, reduce abandonment rates, and boost revenue.

Key Takeaways:

Real-Time Data: Spot and solve payment issues instantly, especially during high-demand events like sports matches.

Pinpoint Problem Areas: Identify where users face friction (e.g., card verification) and make targeted changes.

AI-Driven Personalization: Tools like Fluid adjust payment flows based on user behaviour, making payments faster and more intuitive.

Fraud Prevention & Compliance: Real-time monitoring flags suspicious activity and ensures adherence to regulations, such as Malta’s €9 999,99 cash payment limit.

Localisation for Malta: Use euro (€) formats (e.g., €1 234,56), DD/MM/YYYY dates, and 24-hour time to align with local preferences.

By combining real-time insights with tailored solutions, you can create smoother, more secure payment experiences that keep players engaged.

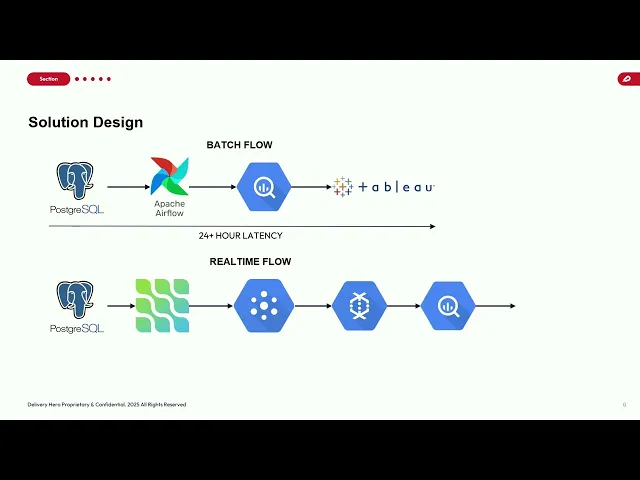

Big Data Minds Europe 2025 - Delivery Hero - Real-time analytics for payment solutions

Main Problems in Tracking User Events for Payment Optimisation

When it comes to improving the user payment journey, having real-time insights is absolutely crucial. One major hurdle in this process is data delays. These delays don’t just slow down transactions - they frustrate users and can lead to a staggering 40% drop in user retention. This directly undermines payment conversion rates and cancels out any earlier gains made in the process.

Delayed Data and Real-Time Analytics Problems

Data delays create a ripple effect, making it harder to make timely decisions and disrupting the entire payment flow. This often leaves players feeling disengaged, which is the last thing you want. To keep users engaged and ensure smooth payment experiences, real-time analytics are not just helpful - they’re essential.

Solutions for Better Payment Flows with Real-Time Event Tracking

Today’s technology offers operators the tools to overcome tracking hurdles, turning reactive payment processes into smooth, proactive experiences that can significantly boost conversions.

Advanced Event Tracking Throughout the Payment Journey

To build a robust tracking system, it’s essential to monitor every step of the payment process. This includes capturing data from the moment a player clicks "deposit" to the final stages, such as account updates or bonus activations.

For complete visibility, implement multi-layered, cross-device tracking that captures both technical events (like page loads and API calls) and behavioural data (such as mouse movements and form interactions). This comprehensive approach helps identify exactly where players succeed or encounter issues.

One critical component is funnel efficiency monitoring. By analysing success rates at each stage and digging into error patterns, operators can pinpoint the areas that need immediate attention and improvement.

Leveraging AI and Automation for Real-Time Insights

AI transforms raw event data into actionable insights almost instantly, cutting out the delays associated with traditional reporting methods.

The role of AI in personalisation is particularly striking - 80% of customers value AI-driven personalisation in sports betting offers. This underscores how intelligent automation can elevate user satisfaction and improve conversion rates.

For example, Fluid’s AI adapts payment journeys in real time based on user behaviour and historical trends. If the system detects hesitation during form completion, it can adjust the interface or offer assistance on the spot.

AI also strengthens fraud detection by continuously analysing patterns and flagging anomalies immediately. This shift from manual processes to automated, real-time tracking gives operators a competitive edge, enabling them to predict and resolve issues proactively instead of reacting after the fact. These capabilities integrate seamlessly with existing systems, enhancing the operator’s overall strategy.

Seamless Integration with Existing Systems

A well-designed tracking solution should work effortlessly with existing systems. Modern payment optimisation platforms focus on integration rather than replacement, ensuring minimal disruption during implementation.

With an API-first architecture, these platforms connect smoothly to current payment processors, customer databases, and analytics tools. This allows operators to maintain their established workflows while gaining access to enhanced tracking and insights.

Fluid exemplifies this approach, offering a quick and easy implementation process that requires minimal development work. It integrates seamlessly with existing iGaming systems, providing advanced tracking features that start delivering results immediately.

This hybrid approach - combining AI-driven automation with human expertise - creates a powerful payment optimisation strategy. Automation handles routine tasks like monitoring and immediate issue resolution, while human teams focus on strategic decisions and complex challenges.

Real-time tracking also supports dynamic adjustments, such as modifying deposit limits or pricing strategies based on player behaviour and market trends. This ensures compliance with regulations while maximising revenue - a delicate balance that benefits from both automated tools and human oversight.

Benefits of Event-Driven Payment Optimisation

Event-driven payment optimisation, powered by real-time insights, goes beyond merely improving payment flows. It delivers tangible benefits in conversion rates, user satisfaction, and security measures, making it a powerful tool for operators.

When operators integrate detailed event tracking into their payment systems, they gain more than just data. These insights enable actionable improvements that enhance both operational efficiency and the overall user experience.

Finding and Fixing Payment Bottlenecks

With event-driven analysis, operators can quickly identify and resolve bottlenecks in the payment process. Real-time tracking highlights exactly where users abandon transactions, helping pinpoint the root causes.

Drop-off pattern analysis is particularly valuable in understanding conversion funnels. For instance, if a significant number of users drop off at a specific step, operators can investigate potential issues - be it technical glitches or design flaws - and implement precise fixes instead of overhauling the entire system.

During busy periods, like major football matches or casino promotions, event tracking becomes even more critical. By monitoring metrics such as response times, error rates, and transaction completion percentages, operators can make real-time adjustments to ensure smooth performance when demand spikes.

Event tracking also uncovers device-specific issues. For example, mobile users may face challenges with payment methods that work seamlessly on desktops, while tablet users might encounter different obstacles. Understanding these nuances allows operators to fine-tune the payment experience for each device type, ensuring a seamless journey for all users.

These insights naturally pave the way for creating personalised payment journeys that further enhance the user experience.

Customising Payment Journeys for Better User Experience

Personalisation, informed by user behaviour, can significantly improve payment experiences. Event tracking provides operators with the data needed to tailor the payment journey to individual preferences.

One effective strategy is dynamic payment method prioritisation. For example, if a user consistently chooses e-wallets, the system can automatically prioritise that option, reducing unnecessary decisions and speeding up the process.

Fluid's AI-powered personalisation is a great example of how advanced event tracking can elevate the experience. By analysing user patterns - such as preferred deposit amounts, peak activity times, and commonly used payment methods - the system crafts intuitive, tailored experiences that feel effortless.

Progressive form optimisation is another impactful approach. If data reveals that users often pause at specific form fields, the system can provide helpful prompts or simplify the process, minimising friction and reducing abandonment rates.

Geographic and timing insights also play a role. For instance, event tracking can identify regional payment preferences or peak transaction times, enabling operators to present the most relevant options at the right moments. This level of personalisation not only improves satisfaction but also strengthens security and compliance.

Improving Fraud Detection and Compliance

Event data doesn’t just enhance user experiences - it also bolsters fraud prevention and regulatory compliance by combining technical event tracking with behavioural analysis.

Anomaly detection becomes more precise when user behaviour is factored in. For instance, a deposit that deviates significantly from a player’s usual activity - combined with a very brief interaction on the payment page - might trigger additional verification steps.

Event tracking also simplifies compliance with local regulations, such as those set by the Malta Gaming Authority. It can automatically capture and organise required data points, including player verification actions, transaction timestamps, and geographic details, formatted in DD/MM/YYYY and EUR standards.

A layered security approach benefits from detailed event tracking by adding multiple verification points throughout the user journey. Instead of relying solely on transaction data, operators can analyse the entire process - from the first page load to final confirmation - to detect suspicious patterns that might indicate fraud.

Additionally, compliance efforts are streamlined as event tracking generates detailed audit trails automatically. Every interaction, system response, and security check is logged with precise timestamps, making it easier to meet regulatory requirements during audits or investigations.

This holistic approach to fraud prevention and compliance not only safeguards both operators and users but also supports the creation of seamless, personalised payment experiences that encourage engagement and boost revenue.

Localising Payment Optimisation for Malta (en-MT)

To optimise payments effectively in Malta, operators need more than just robust event tracking systems. They must also align with local standards and regulations. By tailoring payment systems to Maltese preferences and compliance frameworks, businesses can provide seamless user experiences while avoiding regulatory issues. Customising event tracking to meet Malta's specific requirements ensures operators capture real-time insights, meet user expectations, and stay compliant.

As a leading hub for iGaming, Malta demands that operators strike a balance between exceptional user experiences and strict regulatory compliance. Localisation isn’t just about converting currencies; it includes adapting data formats, compliance tracking, and regulatory reporting to align with Maltese standards. Combining these elements with real-time event tracking enhances the overall efficiency of payment systems.

Using Maltese Currency, Date, and Number Formats

Localisation starts with presenting financial data in formats familiar to Maltese users. Event tracking systems should capture and display data using the correct conventions for the euro (€), including the proper use of decimal and thousand separators. For example, amounts should be formatted as €1 234,56, which aligns with local expectations and builds trust by reducing cognitive friction.

Date formatting is another crucial factor. Maltese users expect dates in the DD/MM/YYYY format. For instance, a transaction dated 15 March 2025 should appear as 15/03/2025, not 03/15/2025 or 2025-03-15. Similarly, time formatting should follow the 24-hour clock system commonly used in Malta. Payment completion times should be displayed as 14:30 instead of 2:30 PM to ensure clarity and consistency.

These formatting conventions should extend to analytics dashboards and reporting tools. When reviewing payment performance, presenting data in familiar formats allows operators to make faster, more accurate decisions, reducing the risk of misinterpretation during critical optimisation processes.

Meeting Maltese Regulatory Requirements

Compliance with Maltese regulations is non-negotiable. The country’s regulatory framework, particularly in the iGaming sector, requires advanced event tracking systems that go beyond basic transaction monitoring. The Malta Gaming Authority (MGA) mandates detailed audit trails and comprehensive record-keeping, which can only be achieved through sophisticated tracking capabilities.

For example, Malta enforces strict cash payment limits. Transactions linked to the same parties that exceed €9 999,99 within a six-month period are prohibited, with severe penalties for non-compliance. Operators must deploy tracking systems capable of identifying linked transactions. This involves monitoring not just individual amounts but also party details, transaction purposes, and timing patterns over extended periods.

Consider a scenario where an individual attempts two cash payments of €7 000 each for the same service within six months. This would be flagged as a linked transaction exceeding the legal limit. Advanced event tracking systems can detect such patterns, enabling operators to prevent violations before they occur.

Fluid’s AI-powered platform is particularly well-suited to Malta’s regulatory landscape. It captures all necessary data points, formats transaction records according to Maltese standards, and generates compliant audit trails. Additionally, it monitors compliance in real time without disrupting the payment process, ensuring a smooth experience for users.

Geographic and timing insights also play a critical role. By analysing peak transaction periods that align with Maltese business hours or local events, operators can optimise system performance during high-demand times while maintaining robust compliance monitoring.

By integrating regulatory requirements into payment optimisation strategies, operators can ensure compliance without compromising user experience. Intelligent event tracking enables businesses to meet legal obligations while delivering efficient, personalised payment journeys that drive growth.

This holistic approach to localisation ensures payment systems cater to Malta’s unique regulatory and user expectations, laying a strong foundation for sustainable success in the iGaming industry.

Conclusion: Achieving Payment Optimisation Through User Event Tracking

Optimising payments in the iGaming industry hinges on three key components: real-time event tracking, actionable insights, and tailoring solutions to local market needs.

Real-time tracking is a game-changer. It provides instant insights, allowing operators to act swiftly and prevent revenue loss in critical moments. In an industry like iGaming, where even a brief delay can lead to abandoned transactions or player drop-offs, this level of responsiveness is invaluable.

Actionable data is the foundation for meaningful improvements. Advanced event tracking and segmentation empower platforms to increase conversions and improve campaign ROI by delivering targeted user experiences. By analysing specific user behaviours - such as where payment processes fail or users drop off - operators can refine their systems and create more personalised payment flows. Tools like auto-capture simplify this process by logging user interactions - clicks, submissions, and scrolls - without needing manual input. This not only fills data gaps but also reduces the workload for developers, enabling more effective optimisation efforts.

The benefits of this approach extend beyond conversion rates. Enhanced fraud prevention, regulatory compliance, and user trust are all part of the equation. For markets like Malta, localisation is crucial. Payment systems must reflect local preferences, such as currency formats (€1 234,56) and date conventions (DD/MM/YYYY). Adapting to these specifics not only builds trust but also minimises the cognitive load on users, making payment processes smoother and more reliable.

Platforms like Fluid exemplify this integrated approach. By offering personalised payment journeys, real-time insights, and advanced fraud detection, Fluid empowers operators to make smarter, data-driven decisions. The platform’s seamless integration with existing systems ensures compliance and security while driving revenue growth.

Looking ahead, AI-driven tools, composable systems, and auto-capture event tracking represent the next phase of payment optimisation. These technologies streamline processes, reduce manual effort, and enable faster, more precise decision-making.

Ultimately, success in payment optimisation demands a commitment to constant improvement. Regular evaluations, collaborative efforts across teams, and iterative updates ensure payment systems not only meet user expectations but also stay ahead of regulatory changes. When done right, event tracking transforms payment challenges into opportunities, enhancing both revenue and user satisfaction.

FAQs

How can tracking user events in real-time improve payment processes in iGaming?

Real-time tracking of player actions gives iGaming operators instant access to valuable insights into how users behave - like their deposit habits, transaction sizes, and session activities. This kind of data plays a key role in refining payment processes, making them smoother and more tailored to each player's preferences.

With these insights, operators can make quick adjustments to payment systems, cutting down on obstacles, improving conversion rates, and spotting potential fraud early on. The result? A more secure, seamless payment experience that not only builds trust but also helps drive revenue by aligning with what players need and expect.

How does AI enhance payment experiences for users?

AI transforms payment experiences by analysing real-time user behaviour and preferences to deliver customised payment solutions. This could mean offering payment methods suited to individual needs, flexible instalment options, or smoother checkout processes - all designed to make transactions hassle-free and straightforward.

On top of that, AI enables businesses to offer instant, smart support, cutting down on wait times and giving users the tools to handle payment-related queries on their own. Plus, AI-powered systems play a critical role in identifying and preventing fraud, ensuring a safe and efficient payment process for both customers and businesses alike.

How can operators in Malta optimise payment systems while staying compliant with local regulations?

To keep payment systems running smoothly and within the law in Malta, businesses need to stick to the rules set by the Central Bank of Malta and the Malta Financial Services Authority (MFSA). These bodies oversee everything from system participation to cash restrictions and ensure alignment with EU directives like DORA.

Carrying out regular self-assessments is a must for staying on top of both local and EU regulations. Using tools like real-time user event tracking can help businesses fine-tune payment processes while staying compliant. By focusing on solutions that emphasise security, fraud prevention, and a smooth user experience, companies can not only meet regulatory demands but also enhance how efficiently they operate.