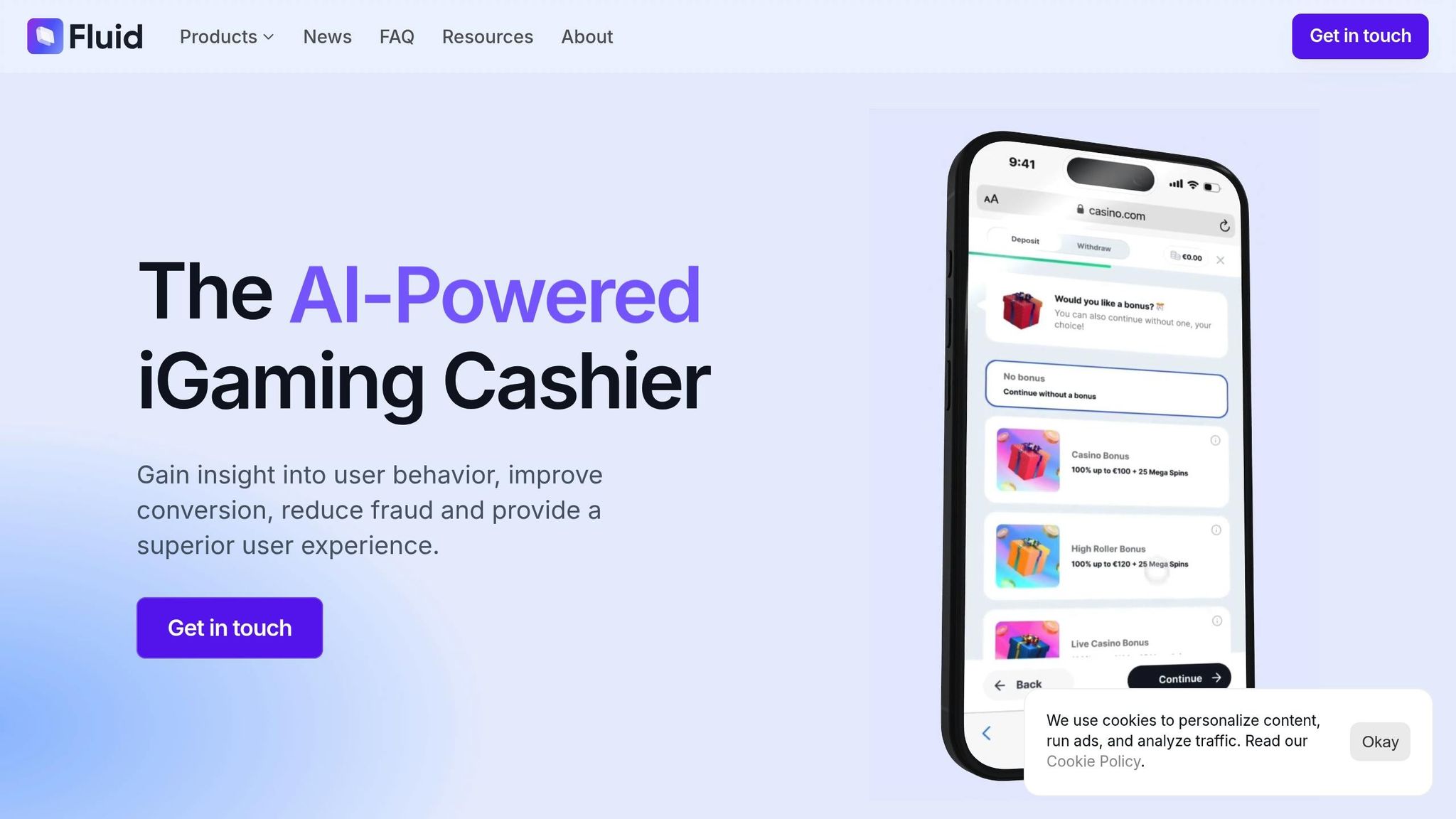

How Fluid Works With Any Orchestration Layer to Boost Conversion and Control

Oct 13, 2025

Fluid

Fluid enhances payment experiences for iGaming platforms with AI-driven personalisation, smart routing, and seamless integration into existing systems.

Fluid simplifies payments for iGaming platforms by integrating with existing systems and improving transaction success rates. It uses AI to personalise payment options, optimise routing, and detect fraud in real time. Players enjoy faster deposits, quicker withdrawals, and tailored payment experiences, while operators gain control through detailed analytics and compliance tools.

Key Benefits:

AI-Driven Personalisation: Matches payment options to player habits and preferences.

Smart Routing: Automatically selects the best payment processor to reduce failures.

Fraud Detection: Real-time monitoring minimises risks without blocking legitimate transactions.

Quick Integration: Works with current systems using APIs and pre-built connectors.

Localisation: Adapts to regional payment methods, currencies, and compliance standards.

Fluid delivers a smoother, more reliable payment experience for players in Malta and Europe while giving operators the tools to manage and optimise their payment processes effectively.

Episode 17 - How Payment Orchestration Simplifies Cross-Border Transactions #crossborderpayment

How Fluid Works With Any Orchestration Layer

Fluid is designed to integrate effortlessly with existing payment orchestration systems, blending seamlessly into current workflows without disrupting established processes. This approach allows iGaming platforms to boost their payment capabilities while preserving their existing technical setups. Essentially, Fluid acts as a bridge, connecting traditional orchestration systems with its advanced features.

Works With All Platform Types

Fluid connects smoothly with any payment orchestration layer, giving iGaming operators the ability to enhance their payment processes without losing control. Using standardised APIs and webhooks, the platform adapts to various setups, whether operators rely on established payment service providers, direct acquirer relationships, or hybrid systems. The best part? No major architectural changes are needed.

The platform also supports multiple currencies, including euros (€), British pounds (£), US dollars ($), and cryptocurrencies like Bitcoin and Ethereum. But it goes beyond simple currency conversion - Fluid ensures each currency type has its own dedicated processing flow. This means transactions are routed efficiently while staying compliant with regional requirements, all while supporting workflows tailored to specific currencies.

Fluid’s decision engine is another standout feature. It evaluates every transaction in real-time, analysing factors like available processors, success rates, and regulatory requirements. When a player makes a deposit, the system determines the best routing path within milliseconds, ensuring smooth and efficient payment processing.

Easy Setup and Fast Deployment

Getting started with Fluid is quick and hassle-free. Most integrations are completed in days, not weeks, thanks to pre-built connectors for major orchestration systems. This simplicity reduces the technical burden typically associated with upgrading payment systems.

The setup involves three key steps: API integration, webhook configuration, and brand customisation. Operators can keep their existing payment processor relationships intact while layering Fluid’s AI-driven personalisation features on top. This means no disruption to current agreements or regulatory compliance, but with added benefits for players.

Fluid’s low-code approach simplifies the process even further. Technical teams receive detailed documentation, sandbox environments, and ongoing support to ensure a smooth implementation. The modular design allows operators to activate features gradually, starting with basic personalisation and expanding to advanced tools like fraud detection and analytics.

Before going live, operators can test everything in controlled sandbox environments. These environments mimic real transaction flows, allowing teams to simulate various payment scenarios, test orchestration responses, and check compliance requirements. This thorough testing ensures a smooth transition with minimal risk.

Local Payment Flows for Malta and Europe

Fluid understands that payment preferences across Europe vary greatly depending on location and demographics. That’s why it tailors payment options to match the expectations of players in specific regions.

For players in Malta and Europe, Fluid formats currency displays according to local conventions. For instance, continental European users see amounts like €1.500,00, while UK-based players see €1,500.00. These small details build trust and improve completion rates.

Compliance is another area where Fluid excels. The platform incorporates mapping for European regulations, including Malta Gaming Authority standards, GDPR, and Anti-Money Laundering directives. These checks are seamlessly integrated into the payment flow, ensuring compliance without interrupting the user experience.

Fluid also prioritises local payment methods. For example, German players might see SEPA bank transfers and Sofort as primary options, while Dutch users are presented with iDEAL. Beyond just showing the right methods, Fluid optimises the entire payment process to align with regional banking practices and user expectations.

To round out the experience, Fluid offers multi-language support. Payment interfaces automatically adjust to the player’s preferred language, including error messages, confirmation screens, and receipts. This ensures a consistent and localised experience that builds confidence and encourages players to complete their transactions. Together, these localisation efforts address the regional complexities discussed earlier, making Fluid a true game-changer for European iGaming operators.

Increasing Conversion Rates With AI-Powered Payments

After implementing smooth orchestration and integration, Fluid uses AI to take conversion rates to the next level. By analysing player behaviour in real time, Fluid's AI fine-tunes payment flows on the spot. This reduces friction that often causes players to abandon transactions, giving iGaming operators a much-needed boost in completed payments.

Real-Time Personalisation and Adjustments

Fluid's AI engine keeps a constant eye on how players interact with payment interfaces, considering factors like device type and transaction history. For example, when a returning player makes a deposit, the system identifies their preferences and adjusts the flow accordingly.

For mobile users, the process is simplified with single-tap payment methods and minimal form fields.

For desktop users, more detailed payment options with added security features might be offered.

Every transaction is personalised using a wealth of data points, ensuring quick adjustments that minimise delays. This dynamic approach guarantees players experience payment processes tailored to their region, device, and habits.

Brand Integration Without Generic Frames

Generic payment interfaces often disrupt the gaming experience, redirecting players to unbranded, white-label pages. Fluid eliminates this issue by embedding payment functionalities directly into the operator's branded environment.

Operators can fully customise the payment visuals to match their branding, keeping players in a familiar and trusted setting throughout the process. This continuity not only builds trust but also reduces the chances of players abandoning their transactions.

But Fluid doesn’t stop at visual customisation. The platform maintains the operator's URL structure, reinforcing a seamless and reliable experience. With pre-built components that integrate effortlessly into the operator's brand, Fluid offers a professional-grade solution with minimal development effort.

Local and Smooth Payment Experiences

Fluid goes further by refining the payment journey to reflect regional preferences and practices. It recognises that payment habits vary across Europe, especially in Malta, where players expect a payment experience that aligns with local banking norms.

For Maltese users, Fluid ensures amounts are displayed in local currency formats. The system detects player location and adapts number formatting, date styles (DD/MM/YYYY), and currency symbols to match local expectations. This attention to detail fosters familiarity and encourages players to complete transactions.

Fluid also prioritises popular regional payment methods. For instance, Maltese users might see bank transfers and local card processors as primary options, while still having access to international methods. Over time, the AI learns user preferences and adjusts the presentation order of payment options to match evolving trends.

Localisation goes beyond just language. Payment terminology, error messages, and confirmation screens are tailored to reflect local banking language and meet regulatory requirements. For example, GDPR compliance notices are delivered in clear, locally relevant terms, building trust with users.

Additionally, Fluid considers local banking hours and processing times when presenting payment options. By offering accurate estimates of when funds will be available, the platform reduces support enquiries and improves player satisfaction. The result is a payment experience that feels natural and intuitive, no matter the market.

Giving Operators More Control and Data

Fluid gives operators the tools they need to move beyond reactive problem-solving and focus on optimising payments. With detailed, real-time insights, the platform ensures operators have complete control over payment flows while providing the data necessary to make decisions that can drive revenue growth.

Real-Time Data for Payment Optimisation

Fluid's seamless integration doesn’t just simplify processes - it equips operators with actionable insights to fine-tune payment performance. The platform’s analytics dashboard offers instant visibility into how all payment channels are performing. From the first payment attempt to final settlement, every transaction is tracked, creating a full picture of payment flow efficiency.

Operators can analyse conversion rates by payment method to identify which options work best for different player groups. The dashboard also highlights transaction velocity patterns, showing when payment volumes peak and which methods are in highest demand. This insight helps operators allocate processing resources effectively during busy periods.

Regional preferences are also accounted for, with geographic performance metrics shedding light on local payment trends. Transaction amounts are displayed in local currency formats - like €1.234,56 for European markets - making financial data easier to interpret. On top of that, real-time alerts notify operators of any sudden drops in conversion rates or unusual transaction patterns, allowing for immediate action.

AI-Powered Fraud Detection and Compliance

Fluid’s AI works around the clock to safeguard transactions. It analyses data points like device details, timing, and payment methods to detect potential fraud. High-risk transactions are flagged for further review, while low-risk payments proceed without delay. For KYC and AML compliance, the system simplifies verification processes by adhering to local regulations, using ongoing monitoring and detailed audit trails with timestamps in the DD/MM/YYYY HH:MM format.

Configurable Payment Controls

Backed by detailed analytics and advanced fraud detection, operators gain precise control over their payment settings. Fluid allows for customisation of transaction limits based on player segments, management of dynamic surcharges, enforcement of geographic restrictions, and implementation of velocity controls. Operators can also prioritise payment methods, offering local options for Maltese users while highlighting global methods for international players. These adjustments take effect immediately across the system, ensuring seamless operations.

Benefits of Fluid's Platform-Independent Approach

Fluid's platform-independent design takes the payment experience to the next level by combining robust control with real-time analytics. This setup not only boosts payment performance but also enhances player satisfaction and streamlines operations. By allowing operators to make the most of their existing infrastructure, Fluid unlocks advanced payment functionalities without the need for a complete overhaul.

Reducing Failed Transactions With Smart Routing

At the heart of Fluid's system lies smart routing, a feature designed to minimise payment failures. The platform keeps a constant eye on payment success rates across various processors, automatically funnelling transactions through the most reliable channels. If one payment provider faces downtime or a surge in declines, Fluid seamlessly reroutes transactions to other available processors. For transactions within Europe, it even adapts to local currency formats while leveraging real-time data to optimise routing decisions.

Fluid’s AI-driven personalisation further enhances smart routing by tailoring transaction paths to specific conditions. The system evaluates success rates based on region, payment method, and transaction amount. For example, a payment method thriving in Malta might not perform as effectively elsewhere in Europe. Fluid dynamically adjusts its routing strategies to reflect these regional differences. Additionally, cascade routing comes into play for high-value transactions. If a primary processor declines a transaction, secondary or even tertiary options are automatically attempted, significantly reducing the need for manual intervention and ensuring smoother payment flows.

Custom Payment Journeys for Different Player Groups

Fluid's flexibility allows operators to craft payment experiences that cater to the unique needs of different player segments. By analysing factors like player behaviour, preferred payment methods, and transaction history, the platform creates customised payment interfaces.

VIP players receive priority treatment with faster processing and access to exclusive payment options. For instance, they may see prominently displayed cryptocurrency options or direct bank transfers that offer quicker settlements and higher transaction limits.

Casual players encounter a more straightforward interface, focusing on familiar payment methods like debit cards and e-wallets, which are easy to use and have higher success rates for this group.

Mobile-first players benefit from optimised forms and one-click payment options designed for touchscreens. Digital wallets and other mobile-friendly methods are prioritised to ensure a seamless experience.

By tailoring payment journeys to these groups, Fluid not only simplifies the process but also improves settlement speeds and reliability.

Building Player Trust Through Faster Settlements

Speed is a key factor in building trust, and Fluid delivers with faster settlements. By integrating with payment processors that specialise in rapid settlements, the platform shortens the time it takes for players to receive their funds after a withdrawal request.

The system also includes real-time settlement tracking, giving players transparent updates on their transaction status. Instead of vague messages like "processing", players see clear updates with estimated completion times based on their chosen payment method and the current performance of the processor.

For those who value speed above all, instant withdrawal options are available. Fluid's flexible integrations connect to both traditional banking systems and modern instant payment services, giving operators the ability to offer premium, rapid settlement methods. Players who prefer to save on fees can still opt for standard processing times, which may take slightly longer.

Settlement times vary depending on the method and region. For example, e-wallet withdrawals are often completed within hours, while bank transfers may take 1-2 business days but come with lower processing fees. For large withdrawal requests, Fluid supports partial settlements, allowing approved portions to be processed immediately while additional checks are completed for the remaining amount. This ensures players get access to part of their funds sooner without compromising security.

To further build trust, the payment interface includes clear trust indicators. These display specific time estimates for fund delivery, helping players know exactly when to expect their money. This transparency not only improves the overall experience but also reduces the number of support queries about withdrawal statuses, keeping players informed and satisfied.

Conclusion: Transforming iGaming Payments With Fluid

Fluid takes a fresh approach to iGaming payment management, offering a platform-independent solution that integrates effortlessly with any orchestration layer. This allows operators to maintain complete control over their payment systems while seamlessly working with existing infrastructure. By combining various layers into one unified system, Fluid enhances the operational efficiencies outlined earlier.

The platform leverages AI to customise payment flows and intelligently reroute transactions if payment processors face issues, ensuring uninterrupted gameplay for users.

What sets Fluid apart is its real-time analytics and AI-driven fraud detection, which provide operators with greater insight into payment performance. It adapts to local preferences and offers transparent settlement tracking, fostering trust among players. Additionally, its guided user experience keeps players informed with real-time updates, reducing the need for support and boosting overall satisfaction.

Fluid also integrates payment interfaces into operators' branding, creating a consistent and familiar experience for players. With a mobile-first design and user-friendly guidance, it delivers the smooth payment processes that modern players demand.

Its rapid integration process requires minimal development effort, allowing operators to quickly implement advanced payment features. Support for multiple currencies, including cryptocurrencies, ensures that players from diverse regions enjoy a seamless and reliable payment experience.

FAQs

How does Fluid use AI-driven personalisation to improve payment experiences for players across different regions?

Fluid takes AI-driven personalisation to a new level by shaping the payment experience around each player's unique behaviour and preferences. Through real-time analysis of user interactions, Fluid adjusts the wallet interface to create a deposit process that feels effortless and customised to individual needs.

This smart approach doesn’t just make players happier - it also helps streamline payments, making them quicker, easier, and more relevant, no matter where players are based. At the same time, operators enjoy better control over payment flows while providing an elevated experience for their users.

How can Fluid be integrated with an existing payment orchestration system, and how long does the process take?

Integrating Fluid into your current payment orchestration system is designed to be straightforward and hassle-free. The platform is built to work smoothly with a variety of systems commonly used in the iGaming sector.

The time it takes to integrate Fluid largely depends on the complexity of your existing setup and your specific business needs. That said, the process is typically quick and can often be wrapped up in just a few days, keeping any operational disruptions to a minimum. Our team is on hand every step of the way, offering full support to ensure everything runs smoothly and performs as expected.

How does Fluid comply with regional regulations while delivering a smooth user experience?

Fluid is built to align with the regulatory frameworks of various regions, ensuring operators stay compliant while offering a smooth payment experience. It incorporates localised compliance measures like anti-money laundering (AML) checks and player verification processes, enabling businesses to meet legal requirements without compromising user convenience.

What sets Fluid apart is its adaptable system, which can be updated effortlessly to keep pace with changing regulations. This ensures that iGaming operators in Malta and other jurisdictions remain compliant. By prioritising these measures, Fluid not only protects operators but also strengthens player trust and confidence.