Fluid’s Integration Freedom: Connect Once, Expand Everywhere

Jan 10, 2026

Fluid

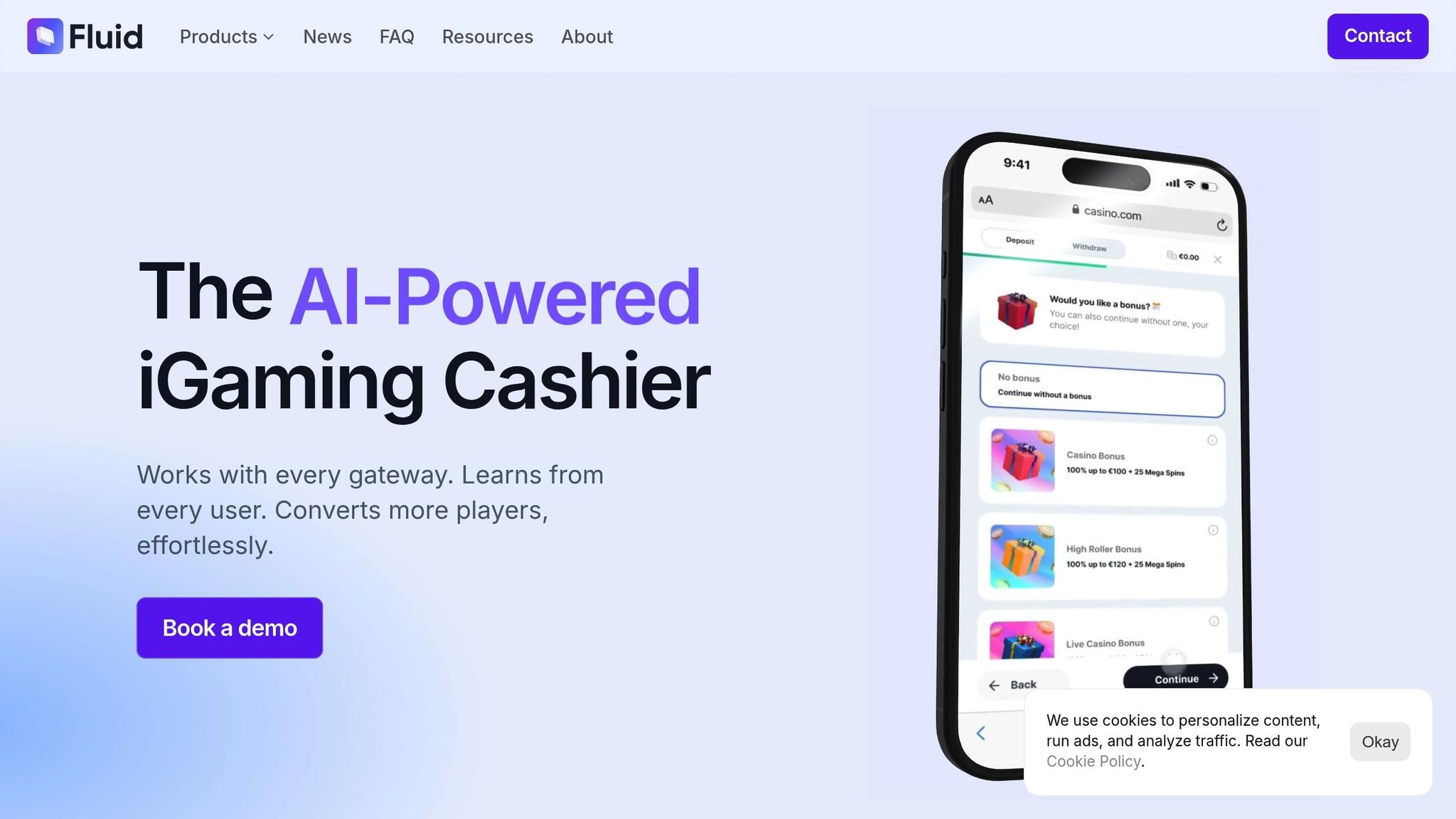

Single-API payment orchestration for iGaming that reduces integration time, supports multi-currency and crypto, and adds AI-driven routing and fraud detection.

Fluid revolutionises payment management in the iGaming sector with a single API connection, eliminating the need for separate integrations for each payment provider, region, or currency. This approach drastically reduces setup time from weeks to minutes, allowing operators to focus on growth and player experience. Key benefits include:

Single API Access: Connect once to access multiple gateways and payment methods.

Dynamic Routing: Automatically reroutes transactions to the most reliable processor, ensuring high approval rates.

AI-Driven Insights: Real-time analytics optimise payment flows and reduce drop-offs.

Multi-Currency & Crypto Support: Handles payments in euros (€), US dollars ($), and cryptocurrencies like Bitcoin and Ethereum.

Fast Setup: Integrate with just two lines of JavaScript and configure in under a day.

This system simplifies compliance with Malta Gaming Authority (MGA) regulations and supports businesses of all sizes - from startups to enterprises - by streamlining operations and improving transaction reliability. With Fluid, operators can expand payment capabilities without the technical burden of traditional systems.

Ashley Lang: Breaking down the iGaming eco-system - NEXT.io Podcast

How Fluid's Single Integration Works

Fluid takes the complexity out of iGaming payments by offering a streamlined solution that connects platforms to gateways, processors, and services through a single integration. Here's how it works.

Fluid acts as a payment orchestration layer, consolidating multiple providers into one unified API. Instead of setting up separate connections for each payment gateway or processor, operators gain instant access to a network of options with just one integration. This approach not only simplifies technical work but also ensures continuous uptime and optimal routing without requiring additional coding.

From an operational standpoint, Fluid centralises payment management. Rather than logging into multiple dashboards, operators can monitor all activity - whether it’s tracking euro deposits, cryptocurrency transactions, or approval rates across various markets - in one place. For Malta-based operators handling transactions like €1,000.00, this unified system reduces the administrative hassle of juggling different platforms.

Unified API for Global Reach

Fluid’s API is designed to handle a wide range of currencies and payment methods, enabling seamless global operations. This is a game-changer for platforms catering to both Maltese and international players. For instance, operators can process a €50.00 deposit from a local player and a $100.00 transaction from a North American customer using the same infrastructure. As cryptocurrency continues to gain traction in iGaming, Fluid also supports digital assets like Bitcoin and Ethereum alongside traditional payment methods, all without adding unnecessary complexity.

Fast Integration

Setting up Fluid is incredibly straightforward. Instead of spending weeks on API documentation and custom development, operators can integrate the system with just two lines of JavaScript. This plug-and-play approach turns what used to be a lengthy project into a task that takes mere minutes. Once the JavaScript is in place, operators can configure payment methods and customise the interface in less than a day. This quick setup is ideal for platforms looking to enter new markets or experiment with different payment options without committing significant resources. Adding a new gateway - say, to support a local payment method - requires only configuration changes, not an entire development project.

AI-Driven Analytics and Personalisation

Fluid doesn’t just simplify payments; it also uses AI to optimise the payment experience. By analysing player behaviour in real time, the system identifies patterns, such as preferred payment methods or potential friction points. This data drives features like AI-powered prompts that guide players to their preferred options and highlight relevant bonuses. For operators, these personalised tweaks lead to higher conversion rates, as the system continuously adapts to user behaviour without the need for manual intervention or complex rule-setting.

Key Features That Drive Scalability

Fluid's platform offers a range of features designed to streamline operations and support growth without technical hiccups. By leveraging these tools, it ensures both a seamless player experience and the ability to scale effortlessly.

Multi-Currency and Crypto Support

Fluid handles both fiat and cryptocurrency transactions with ease, presenting amounts like €10,000.00 in line with Malta's formatting standards. For operators based in Malta, this means they can process a €1,234.56 deposit from a local player and a cryptocurrency transaction from an international user - all without switching systems. The platform's ability to handle multiple currencies and payment types simplifies expansion into new markets, removing the need for separate payment systems for each region or currency type.

AI-Powered Fraud Prevention

Fluid's digital cashier includes a robust fraud prevention system powered by AI. It evaluates transactions in real time, using behavioural analysis to monitor login patterns, gameplay activity, and transaction history. Suspicious activities, such as irregular betting or bot-like behaviour, are flagged without disrupting genuine players. Tools like device fingerprinting track shared devices and IP addresses to prevent collusion. For operators following MGA regulations, this automated system ensures compliance without requiring manual checks for every transaction. Plus, the AI evolves to counter new fraud tactics, keeping security strong as transaction volumes grow.

Branded Payment Experience

Fluid enhances the payment process with a sleek, customised interface. Instead of outdated iframes, it uses a fast native WebComponent that can be embedded with just two lines of JavaScript. This interface is fully customisable and optimised for mobile devices - a must for Malta's mobile-heavy iGaming audience. Real-time AI suggestions guide players to their preferred payment methods, and in-game quick deposits let users add funds without leaving the action. This mobile-first approach eliminates the hassle of generic payment pages, keeping players engaged while transactions are processed smoothly in the background.

How iGaming Operators Use Fluid

Fluid stands out for its ability to integrate across a wide range of operator needs. Whether it's a newly launched startup or a well-established enterprise managing operations on a global scale, Fluid's flexibility ensures it fits seamlessly. For instance, a Maltese startup can use the same core technology that powers major platforms, scaling its features as the business expands.

Scalable Solutions for Startups

For Maltese startups, having a reliable payment system without lengthy development timelines is crucial. Fluid's plug-and-play setup connects startups to multiple payment gateways almost instantly. This means a cashier system can be up and running in less than a day, accepting everything from local card payments to cryptocurrency deposits. By eliminating the need for separate integrations, startups can focus on attracting players while keeping costs tied to transaction volumes instead of hefty upfront investments.

Enhanced Payment Journeys for Mid-Sized Operators

Mid-sized operators often grapple with issues like payment drop-offs and unclear reasons for abandoned deposits. Fluid tackles this with analytics that pinpoint friction points by tracking user behaviour from initial click to completed deposit. On 30 October 2025, Fluid teamed up with iConvert to integrate AI-driven cashier technology. This partnership introduced smarter prompts and flexible gateway options, helping operators optimise payment processes, reduce abandonment rates, and increase revenue. This adaptability also opens doors for further customisation, which is particularly valuable for larger platforms.

Tailored Solutions for Enterprises

Large-scale platforms operating across multiple jurisdictions need advanced, customisable features. Fluid's Enterprise plan delivers exactly that, offering fully tailored options like branded interfaces and smart routing based on player location and payment methods. In August 2025, Fluid collaborated with VINN.com to enhance cashier experiences across Europe. This partnership introduced seamless deposit systems and AI-driven personalisation, boosting both deposit frequency and transaction values while reducing fraud through real-time insights. These tools allow enterprises to maintain consistent branding, cater to regional payment preferences, and meet diverse regulatory demands efficiently.

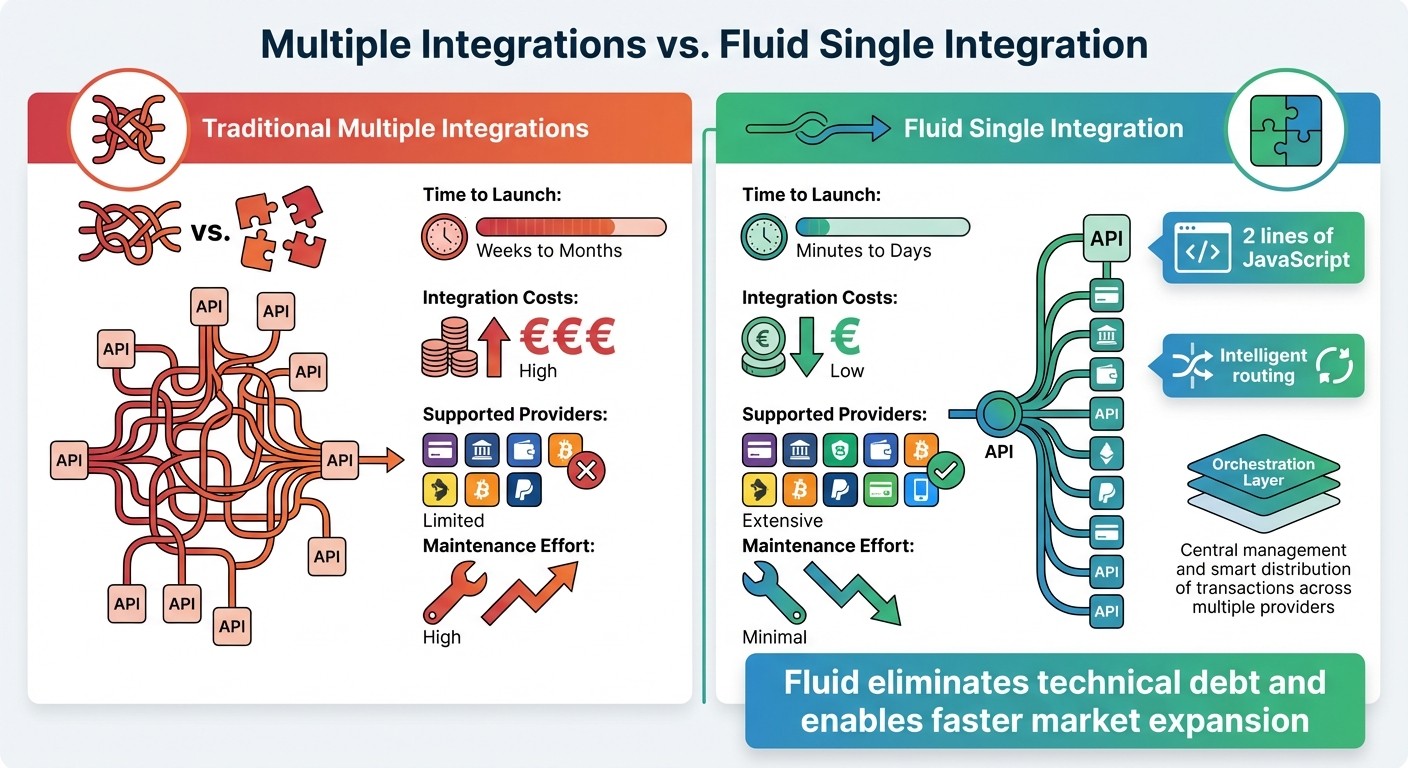

Comparing Multiple Integrations to Fluid's Single Integration

Traditional Multiple Payment Integrations vs Fluid Single Integration Comparison

Traditional payment system management often requires building separate connections for every payment gateway. Each new provider demands custom coding, extensive testing, and continuous maintenance. Fluid takes a completely different approach by serving as an orchestration layer, connecting to any gateway through a single API. This means you can go live much faster without the repetitive work of creating multiple integrations. This shift highlights Fluid's efficiency and simplicity.

When you compare the two methods, the advantages of Fluid's unified approach become clear. Traditional setups often result in fragile payment processes, where adding a new provider or entering a new market requires revisiting and reworking your entire payment stack. Fluid, on the other hand, centralises payment management. Operators can handle multiple gateways effortlessly, without needing to make additional code changes, saving time and reducing complexity. This approach also helps eliminate technical debt while keeping your systems adaptable as your business grows.

Fluid also redefines how uptime is managed. Instead of relying on static connections, it uses intelligent routing to ensure transactions are sent to the most reliable provider in real-time. If a payment fails, the system automatically retries with alternative gateways - something that traditional manual integrations would require significant custom development to achieve.

Comparison Table: Multiple Integrations vs. Fluid Integration

Feature | Multiple Integrations | Fluid Single Integration |

|---|---|---|

Time to Launch | Weeks to Months | Minutes to Days |

Integration Costs | High | Low |

Supported Providers | Limited | Extensive |

Maintenance Effort | High | Minimal |

Implementation Steps for Malta-Based Operators

Launching a payment system in Malta requires a structured plan that aligns with both technical requirements and the Malta Gaming Authority (MGA) compliance standards. While the process is manageable, operators must focus on both payment functionality and regulatory obligations from the start. These steps leverage Fluid's simplified integration to ensure a seamless and compliant rollout.

Step 1: Evaluate Your Payment Processing Requirements

Begin by analysing your current payment volumes, target markets, and player profiles. This evaluation will help you choose the right Fluid plan for your needs:

Basic: Ideal for smaller platforms exploring new markets.

Pro: Designed for medium-sized operators needing advanced tracking tools.

Enterprise: Tailored for large-scale operations requiring extensive customisation.

Take into account your monthly transaction volumes in euros (€), supported currencies, and whether cryptocurrency options are necessary. To meet MGA compliance standards, designate a Key Compliance Officer and schedule an external systems audit within 60 days.

Step 2: Integrate Fluid's API

Fluid's integration process is straightforward, requiring just two lines of JavaScript to activate the cashier system. Configure the platform to local standards, such as using € for currency, DD/MM/YYYY for dates, and metric measurements. By connecting to Fluid's unified API, you eliminate the need for multiple separate integrations. Completing this setup is essential before processing live transactions.

Step 3: Test and Go Live

Conduct thorough testing of AI-driven payment flows to ensure smooth and personalised payment experiences. Verify fraud detection capabilities and real-time transaction monitoring. Test all payment methods, along with failure scenarios, to confirm that intelligent routing functions correctly. Once live, prepare for MGA audits at the one- and three-year marks. Keep detailed records of all payment transactions and system updates from the very beginning. Successfully completing these tests and launching your system demonstrates Fluid's ability to simplify and enhance iGaming payment processes.

Conclusion: How Fluid Transforms iGaming Payments

Fluid simplifies iGaming payment processing with its single integration system. By adding just two lines of JavaScript, platforms can instantly connect to multiple gateways and payment methods. This eliminates the usual lengthy setup process that traditional integrations demand, saving operators weeks or even months of time.

For Malta-based operators, the benefits go beyond speed. Fluid ensures compliance with MGA regulations while offering parallel gateway execution to maximise uptime and optimise routing. Its AI-powered fraud detection and real-time analytics enhance security and provide valuable insights. With over 5 million transactions processed by May 2025, Fluid has proven its ability to grow alongside its users.

The platform also reduces costs by automating tasks like KYC verification, compliance monitoring, and transaction reconciliation - eliminating the need for additional staff. Even during peak times, such as major sporting events, Fluid handles increased demand seamlessly, without requiring operational adjustments or extra expenses.

On top of operational improvements, Fluid enhances the player experience. Players enjoy fully branded interfaces and personalised payment options tailored to their preferences. The platform supports multiple currencies, including cryptocurrencies, and offers localisation for the Maltese market.

Whether you're launching a new platform with the Basic plan, scaling up with Pro, or managing a large enterprise that requires customisation, Fluid's unified API makes it easy to expand payment capabilities without adding technical challenges. This shift from complex integrations to a straightforward installation redefines global payment processing, offering efficiency and control in one package.

FAQs

What are the benefits of Fluid’s single API integration for iGaming operators?

Fluid’s single API integration offers iGaming operators a straightforward way to connect with multiple payment providers in one go. This eliminates the hassle of setting up technical integrations repeatedly, cutting down on both time and development expenses.

With simplified maintenance, Fluid’s solution keeps operations running smoothly and supports fast, scalable expansion into global markets. This allows operators to channel their energy into improving the player experience, all while leveraging a payment infrastructure designed to meet the ever-changing needs of the iGaming industry.

What payment methods and currencies are supported by Fluid?

Fluid allows effortless multi-currency transactions, including euros (€), while also providing dynamic currency conversion for a variety of international currencies. It supports multiple payment options such as credit and debit cards, e-wallets like Skrill and Neteller, cryptocurrencies including Bitcoin and Ethereum, and local bank transfers. This broad range of choices helps operators meet diverse user preferences, making payment processes more convenient for the iGaming sector.

How does Fluid comply with Malta Gaming Authority (MGA) regulations?

Fluid ensures compliance with Malta Gaming Authority (MGA) regulations by embedding a risk-based AML/CFT framework directly into its payment platform. This system requires operators to appoint a Money Laundering Reporting Officer, conduct identity checks before any gambling activities, and maintain continuous transaction monitoring through real-time AI-driven fraud detection and PCI-DSS-grade security measures. These safeguards help operators meet MGA standards and steer clear of penalties.

Fluid’s KYC and age-verification tools are built to align with MGA rules, ensuring player identities are verified within 72 hours. For deposits exceeding €2,000, the platform initiates enhanced due diligence, while ongoing transaction monitoring flags any suspicious activity. It also adheres to broader EU regulations, including GDPR, AMLD5, and the Digital Services Act, promoting both data security and responsible gambling.

Tailored for the Maltese market, Fluid supports the euro (€) with precise local formatting, offers dynamic currency conversion, and includes reporting tools designed to meet MGA licensing and audit requirements. This makes it a reliable and compliant choice for iGaming operators in Malta.