Why a Gateway-Agnostic Cashier Is the Smartest Move for iGaming Operators

Jan 7, 2026

Fluid

One API to route payments across providers, raising approval rates, cutting failures, supporting local currencies, and easing compliance for iGaming.

A gateway-agnostic cashier simplifies payment processing for iGaming operators by connecting multiple payment providers through a single API. This system ensures smoother transactions, higher success rates, and better player satisfaction by routing payments intelligently based on cost, success rate, and location. Unlike single-gateway setups, it prevents disruptions by using multiple providers, supports local currencies, and offers diverse payment methods like e-wallets, cryptocurrencies, and account-to-account transfers. Operators also benefit from streamlined compliance, fraud detection, and reporting tools, making it easier to manage payments across multiple markets. By improving transaction efficiency and reducing failures, this approach boosts revenue and player loyalty while simplifying operations.

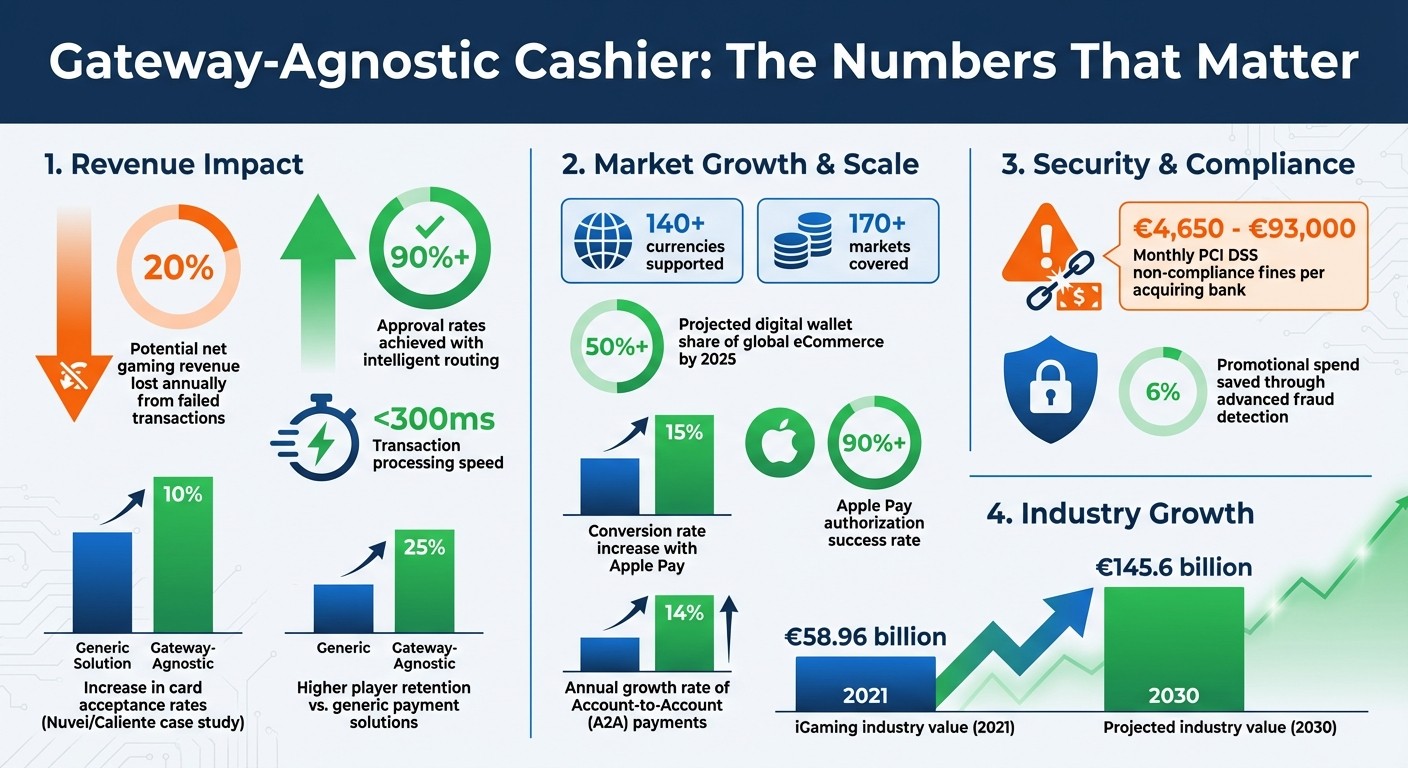

Gateway-Agnostic Cashier Benefits: Key Statistics for iGaming Operators

Revolutionising payments in the gaming industry

What a Gateway-Agnostic Cashier Does

A gateway-agnostic cashier acts as a central connection point, linking iGaming operators to various payment providers through a single API. Instead of building individual connections for each payment gateway, fraud detection tool, or KYC vendor, operators rely on one streamlined integration. This method speeds up market entry and simplifies technical setups. Let’s explore how a unified API and intelligent payment routing can improve transaction success rates.

Unified API and Payment Routing

A unified API eliminates the need for multiple integrations, offering access to a network of payment solutions through one interface. This setup includes dedicated layers for processing transactions, fraud detection, and identity verification.

Payment routing works in real time, evaluating each transaction against predefined rules and performance metrics. The system excels at automatically directing payments based on specific criteria. For instance, when a player makes a deposit or withdrawal, the cashier considers factors like their location, risk profile, and preferred payment method to select the best provider for the transaction. It evaluates success rates, processing costs, and regional expertise to make these decisions. If a primary gateway experiences downtime or increased failure rates, the cashier seamlessly redirects transactions to alternative providers, ensuring uninterrupted service. This redundancy is especially important for operators serving diverse markets, where banking systems and payment preferences can differ greatly.

Additionally, by supporting local currencies and payment methods, the system builds trust among players.

Multi-Currency and Local Payment Options

For iGaming operators targeting global audiences, multi-currency support is a must. A gateway-agnostic cashier handles the euro (€) for Maltese operations while managing over 140 currencies in 170+ markets. Displaying prices in players’ local currencies not only fosters trust but also reduces the likelihood of checkout abandonment.

The system accommodates a wide range of payment methods for both Maltese and international players. These include traditional options like cash, credit and debit cards (Visa, Mastercard, American Express, Diners Club), and newer digital wallets such as Apple Pay and Google Pay. Digital wallets are projected to account for more than 50% of global eCommerce payments by 2025. For example, Apple Pay can increase conversion rates by 15% and boasts over 90% authorisation success.

Beyond these methods, gateway-agnostic systems also embrace emerging payment technologies. Account-to-account (A2A) payments are growing at an annual rate of 14% and offer players faster, more direct transactions. Cryptocurrency processing is another option for eligible merchants, providing benefits like quicker transactions, lower fees, and enhanced privacy.

Financial Reporting and Regulatory Compliance

Gateway-agnostic cashiers come equipped with financial reporting tools that help operators meet Malta Gaming Authority (MGA) requirements. These tools consolidate data from multiple payment providers into unified reports, simplifying tasks like gaming tax calculations and compliance with Anti-Money Laundering/Counter-Financing of Terrorism (AML/CFT) regulations. Malta’s regulatory framework, which aligns with global standards, demands strong monitoring and reporting capabilities - something these systems deliver.

The Payment Card Industry Data Security Standard (PCI DSS) is mandatory for any system handling cardholder data. Gateway-agnostic cashiers include robust security features such as secure network maintenance, data protection, vulnerability management, access controls, and regular system monitoring. Non-compliance can result in severe penalties, with acquiring banks facing fines ranging from €4,650 to €93,000 per month, often passed on to merchants.

Malta’s reputation as a leading payment gateway hub in Europe, bolstered by 2023 research from McKinsey & Company naming it among the top three EU fintech ecosystems, makes regulatory compliance more straightforward. With EU passporting rights, a single licence can cover operations across the EU/EEA. Gateway-agnostic systems also integrate updates to meet regulatory changes, such as Instant Payments and DORA regulations, ensuring better operational resilience and ICT security.

Why iGaming Operators Benefit from Gateway-Agnostic Cashiers

Gateway-agnostic cashiers offer a powerful solution for iGaming operators, helping to increase revenue, improve player satisfaction, and simplify operations. By using intelligent routing and redundancy, these systems address common payment challenges while enhancing the overall gaming experience.

Higher Revenue and Payment Success Rates

Failed transactions can cost operators up to 20% of their net gaming revenue each year. Gateway-agnostic systems tackle this issue head-on by using intelligent routing to ensure payments are processed through the provider most likely to approve them. Factors like success rates, geographical relevance, and cost are all considered to optimise payment approval.

With approval rates consistently above 90% and transaction speeds under 300 milliseconds, these systems minimise disruptions. For instance, when a payment faces a soft decline - a temporary issue that might succeed with another provider - the system automatically retries the transaction through a backup option. A real-world example of this is Nuvei's collaboration with Caliente in 2021, which increased card acceptance rates by 10% thanks to localised transaction routing. Additionally, operators using specialised gaming payment gateways report player retention rates that are 25% higher than those relying on generic solutions.

Features like SCA (Strong Customer Authentication) exemptions for low-risk payments also help reduce friction without compromising security. Tools such as one-click deposits and in-game deposit options make the process faster and more convenient, especially for returning players. Testing multiple payment processors during a soft launch can uncover hidden inefficiencies, enabling operators to optimise their systems from the start.

"It puts power at the fingertips where it belongs of the merchant to be able to look and say you make sense processor A for this geography for this particular product line that we have but you don't make as much sense based on various factors for these other products."

– Shane Estes, Vice President of Sales and General Operations, Inovio

Better Player Experience and Loyalty

Beyond financial gains, gateway-agnostic cashiers significantly enhance the player experience. Players expect quick deposits and withdrawals, and these systems deliver by processing transactions directly on the platform. This eliminates disruptive redirects, keeping the gaming experience smooth and uninterrupted while maintaining brand consistency.

Multi-currency support is another key feature, displaying prices in local currencies - like the euro for Maltese players - and offering a variety of global payment options. Localised interfaces with familiar payment methods and currency symbols build trust, encouraging players to complete their transactions with confidence.

AI-driven personalisation takes things a step further by tailoring payment options to individual preferences based on transaction history and behaviour. This reduces decision fatigue and speeds up the checkout process, creating a more intuitive and satisfying experience that keeps players coming back.

Lower Risk and Simpler Operations

Gateway-agnostic systems also excel at reducing risks and simplifying operational complexities. Automatic transaction rerouting ensures that payments continue to process smoothly even during provider outages. This redundancy prevents revenue loss and minimises player frustration caused by technical issues.

Adding new payment methods is straightforward, thanks to modular service layers and API-based development. Operators can manage all integrations through a single interface, cutting down on operational costs and enabling faster entry into both regulated and emerging markets.

Compliance is another area where these systems shine. Centralised AML/CFT controls make it easier to meet audit and MGA requirements. Built-in KYC/AML checks, deposit monitoring, and bonus verification streamline compliance across multiple jurisdictions. Real-time fraud detection and rule-based alerts proactively identify suspicious activities, safeguarding operations before issues arise.

For operators managing multiple brands or jurisdictions, these systems simplify compliance by offering tailored tools for different regulatory environments. Role-based dashboards ensure that teams - whether in operations, risk, or finance - have access to the data they need without being overwhelmed, reducing training time and minimising errors.

How to Set Up a Gateway-Agnostic Cashier with Fluid

Switching to a gateway-agnostic cashier can be done with minimal disruption to your existing setup. This approach consolidates multiple Payment Service Providers (PSPs) into a single interface, making it easier to manage payment routing across different markets. Fluid's AI-powered digital cashier simplifies this process by managing the technical complexities while giving operators full control over their payment strategies. Here's a closer look at how Fluid makes this transition seamless and effective.

Building Payment Experiences That Players Trust

A successful gateway-agnostic cashier starts with creating payment experiences that players feel comfortable using. A localised interface can make all the difference. Showing payments in local currency, highlighting familiar payment methods, and clearly outlining fees upfront builds trust and reduces the chances of players abandoning the process.

Fluid integrates smoothly with your brand, ensuring that the payment experience feels consistent and reliable. Unlike generic iframes that can disrupt the user journey, Fluid keeps your brand identity intact throughout the process. Features like step-by-step guidance, one-click deposits, and quick withdrawals help reduce friction and improve conversion rates. When players see their preferred payment methods displayed in their local currency, with transparent fees, they’re far more likely to complete their transactions.

Steps to Transition Your Payment System

To upgrade your payment system effectively, follow these key steps. Start by assessing your current setup. Identify which providers handle your transactions, pinpoint areas with frequent failures, and determine which markets require better coverage.

Next, use rules-based engines to optimise acceptance rates by factoring in customer profiles, locations, and transaction types. Connect your chosen payment gateways through Fluid’s unified interface, which acts as a bridge between your cashier and various payment methods like cards, bank transfers, and e-wallets.

Set up routing rules to direct transactions to the most suitable provider based on success rates, costs, and regional performance. Test your system under different scenarios, such as soft declines, outages, and high traffic, to ensure it’s resilient. Finally, gradually move traffic to the new system, keeping a close eye on performance metrics and tweaking routing rules as needed.

Leveraging Fluid's AI for Better Results

Once your payment routing is in place, Fluid’s AI takes things to the next level by optimising payment management. The platform’s machine learning algorithms analyse transaction patterns in real time, automatically routing payments to the most reliable providers. This intelligent routing considers factors like player location, payment method, transaction amount, and past success rates to boost approval rates.

Fluid also uses AI and machine learning for advanced fraud detection. This reduces chargebacks while ensuring legitimate players enjoy a smooth experience. Real-time analytics provide actionable insights into payment performance, helping you identify trends and resolve issues quickly. Additionally, Fluid personalises payment journeys by adapting to individual player preferences based on their transaction history. This reduces decision fatigue by presenting the most relevant options first.

With quick integration that requires minimal development effort, Fluid enables operators to deploy their gateway-agnostic cashier without lengthy technical delays.

Conclusion: Gateway-Agnostic Cashiers Are the Better Choice

Main Advantages at a Glance

Gateway-agnostic cashiers bring a host of benefits to the table. They improve transaction efficiency, cutting payment failures by 20% while keeping approval rates above 90% and latency below 300 milliseconds. This level of operational flexibility eliminates single points of failure, allowing operators to switch between acquirers for better terms and uninterrupted service. Even using multiple merchant IDs helps reduce risk.

This robust setup not only secures operations but also boosts user satisfaction. A smoother experience leads to higher player retention - specialised gaming gateways deliver 25% better retention rates. On top of that, advanced security features help block abuse, saving up to 6% of promotional spend.

These factors make a gateway-agnostic approach a must-have for today’s iGaming businesses.

Get Started with Fluid Today

Fluid’s AI-powered digital cashier brings all these benefits into one seamless solution. It simplifies the technical challenges while giving you complete control over payment strategies, routing options, and provider relationships. With an easy integration process that requires minimal development work, you can implement a gateway-agnostic system quickly and efficiently.

The iGaming industry is expanding fast, growing from €58.96 billion in 2021 to a projected €145.6 billion by 2030. Upgrading to modern payment systems ensures operators are well-positioned to capitalise on this growth while staying agile to adapt to new technologies and regulations.

FAQs

How does a gateway-agnostic cashier help increase payment success rates?

A gateway-agnostic cashier enhances payment success by intelligently routing transactions across multiple payment providers. If one provider declines a payment or experiences an issue, the system automatically redirects the transaction to another provider. This reduces failed payments and keeps the process running smoothly.

By doing so, it not only increases approval rates but also helps avoid disruptions caused by provider outages or regional limitations. The result? A more seamless and dependable payment experience for users.

What are the advantages of offering multiple currencies in iGaming?

Offering a variety of currencies in the iGaming sector brings clear advantages for both operators and players. For operators, it opens doors to a broader audience by accommodating players from different regions, allowing them to handle deposits and withdrawals in their local currency. For players, this convenience improves their overall experience while fostering a sense of trust and loyalty.

On the practical side, accepting multiple currencies can boost transaction success rates by sidestepping issues tied to currency conversion or cross-border payments. It also helps operators cut costs by streamlining payment processes and reducing unnecessary exchange fees. For businesses aiming to thrive in diverse markets, this adaptability is a key factor in achieving sustained growth and keeping players satisfied.

How do gateway-agnostic cashiers help iGaming operators stay compliant with regulations?

Gateway-agnostic cashiers are a vital tool for iGaming operators aiming to stay compliant with shifting regulations. By enabling multi-vendor routing, these systems ensure that payments are processed in line with local laws and standards, providing a seamless way to navigate complex regulatory landscapes.

They also come equipped with adaptable KYC (Know Your Customer) and AML (Anti-Money Laundering) features, simplifying the process of meeting stringent licensing requirements. This is particularly important in maintaining the high compliance standards expected in Malta's competitive iGaming sector.

Another key advantage is the reduced dependency on a single payment provider. This allows operators to respond swiftly to regulatory updates or disruptions in payment services, reducing potential risks and keeping operations running smoothly. In Malta's ever-evolving iGaming environment, this flexibility is not just helpful - it’s essential.