Why Fluid Offers a Superior User Experience Compared to Praxis, PaymentIQ, and Others

Dec 29, 2025

Fluid

Fluid's AI-driven payments deliver fast integration, clear operator tools, and robust fraud detection compared to Praxis and PaymentIQ.

Fluid stands out as a top choice for payment processing in Malta's iGaming sector due to its focus on security, speed, and ease of use. Unlike Praxis and PaymentIQ, which lack transparency about their features, Fluid provides clear, actionable tools for operators and a smooth payment experience for players. Key highlights include:

AI-powered payment flows: Real-time prompts and in-game deposits keep players engaged.

Quick integration: Only two lines of JavaScript embed Fluid into existing systems.

Fraud detection: Advanced AI ensures security without disrupting user experience.

Customisation: Operators can tailor payment journeys using player data insights.

Multi-currency support: Includes Euro (€) and cryptocurrencies with transparent pricing.

For operators in Malta, balancing strict regulations with user expectations is critical. Fluid simplifies this challenge by offering a secure, player-friendly platform that integrates seamlessly into existing systems. While Praxis and PaymentIQ may have strengths, their limited public information creates uncertainty, making Fluid the more reliable option for operators prioritising clarity and performance.

1. Fluid

Player Journey Design

Fluid is all about removing obstacles to create a smooth experience for players. With its AI-powered platform, it offers real-time, context-aware prompts that guide players through deposits. It also enables quick, in-game deposits without interrupting gameplay, ensuring players stay engaged while transactions are processed. The best part? Integration is incredibly straightforward - just two lines of JavaScript embed payment flows directly into the operator's interface. For operators in Malta, this means delivering a trusted and familiar Euro (€) payment experience.

These streamlined payment flows also unlock powerful tools for operators.

Operator Tools and Personalisation

Fluid uses AI to analyse player behaviour, turning data into actionable insights. This allows operators to personalise payment journeys based on individual preferences. The platform supports multiple currencies, including cryptocurrencies, and handles conversions with transparent pricing. Operators can easily manage payment methods via an intuitive dashboard, making configuration a breeze.

But Fluid doesn’t just stop at personalisation - it also takes security seriously.

Fraud Prevention and Security UX

With advanced AI and machine learning, Fluid’s fraud detection system spots suspicious activity while ensuring genuine users experience minimal hassle. This careful balance between security and usability makes it an excellent fit for Malta’s highly regulated iGaming environment.

2. Praxis

Player Journey Design

When it comes to Praxis's player journey design for iGaming, there’s a noticeable lack of publicly available information. Details about interface layouts, checkout processes, or how deposits and withdrawals are integrated remain undisclosed. This absence of transparency makes it difficult to assess how the platform approaches user experience for financial transactions.

Operator Tools and Personalisation

Similarly, information about Praxis's tools for operators or its customisation features is not available to the public. Key aspects such as managing payment methods, handling multiple currencies, or tailoring the platform to meet specific iGaming needs are not documented, leaving operators with unanswered questions about its capabilities.

Fraud Prevention and Security UX

In a regulated market like Malta, security is non-negotiable. However, Praxis does not provide public insights into its fraud prevention measures or how it balances robust security protocols with a seamless user experience. This lack of information makes it harder to evaluate the platform's ability to meet the rigorous demands of the iGaming sector.

The absence of detailed, actionable information about Praxis contrasts sharply with the transparency offered by leading payment platforms. For operators in Malta, this creates challenges in determining whether Praxis is a dependable choice for payment processing needs.

How iGaming Operators Should Choose the Right Payment Provider

3. PaymentIQ

PaymentIQ doesn’t provide much public information about its features, tools, compliance capabilities, or security measures. Unlike platforms that openly share these details, the lack of transparency here leaves operators with unanswered questions about how it functions in practice.

Player Journey Design

There’s very little publicly available information about PaymentIQ’s player journey design. Details such as checkout processes, deposit interfaces, or withdrawal workflows are not readily accessible, making it difficult to evaluate these aspects without further investigation.

Operator Tools and Personalisation

Information about the tools available to operators and the level of customisation offered by PaymentIQ is limited. Key areas like dashboard functionality, payment method configuration, or the ability to tailor the platform to specific business needs remain unclear. This lack of clarity makes it harder for operators to understand how well the platform might align with their operational requirements.

Localisation and Compliance

When it comes to localisation and meeting regulatory requirements, PaymentIQ’s public disclosures are similarly sparse. Details about multi-currency support, compliance with local regulations, or other localisation features are not readily available. These aspects are crucial for successful operation in diverse markets, yet further investigation is needed to verify what PaymentIQ offers in these areas.

Fraud Prevention and Security UX

Strong fraud prevention and security measures are essential in the iGaming sector, but PaymentIQ does not provide much public information about its protocols. There’s no insight into how these measures are implemented or how they integrate with the user experience. Operators may need to dig deeper to fully understand the platform’s security framework and whether it meets local standards.

Strengths and Weaknesses

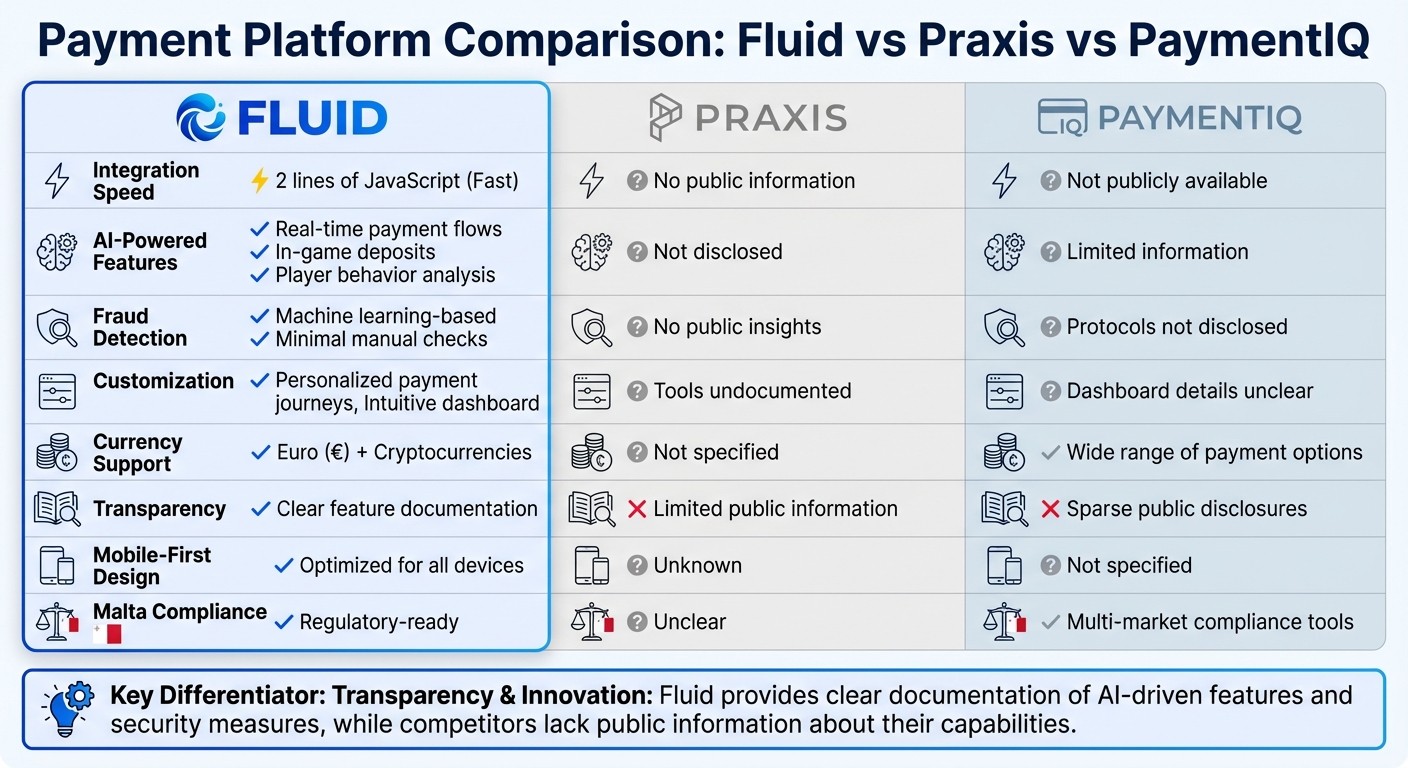

Fluid vs Praxis vs PaymentIQ: iGaming Payment Platform Comparison

This section distils key insights from the earlier analysis, focusing on the practical trade-offs in iGaming payment systems. Understanding these strengths and weaknesses is essential for making informed decisions.

Fluid stands out with its AI-driven payment journeys that not only detect suspicious activity but also adapt to new fraud patterns. Its standout features include fast integration and machine learning–based fraud prevention, making it an excellent choice for operators prioritising security and efficiency. The platform reduces the need for manual checks while maintaining compliance standards. Its mobile-first design and smooth brand integration create a personalised, hassle-free checkout experience for players. These features are particularly suited to Malta's regulatory environment, where secure and efficient transactions are a must. Unlike Fluid, many other platforms provide limited public information about their features.

Praxis, on the other hand, offers very little publicly available information, making it difficult to evaluate its strengths or weaknesses in detail.

PaymentIQ excels in offering a wide range of payment options and robust compliance tools, which are ideal for large-scale, multi-market operations. However, the platform's lack of transparency regarding its features, security measures, and customisation options can make it harder for operators to assess its suitability.

The key difference lies in transparency and innovation. Fluid clearly communicates its AI-driven approach, real-time monitoring, and security features, giving operators a clear understanding of its capabilities. Meanwhile, PaymentIQ's lack of detailed public information creates uncertainty. For operators looking for advanced fraud detection, minimal manual intervention, and quick deployment, Fluid's solution is a strong contender. However, for those managing complex operations across multiple jurisdictions, PaymentIQ's extensive payment network may justify the effort required to uncover more about its offerings.

Conclusion

For iGaming operators in Malta, finding a payment solution that blends security, efficiency, and a seamless user experience is crucial. Fluid stands out with its AI-driven personalised payment journeys, quick integration process, and mobile-first design - offering solutions tailored to the specific demands of the Maltese market. Its transparent use of machine learning for fraud detection, combined with real-time user behaviour insights and flexible customisation options, empowers operators to maintain a secure and efficient payment system while delivering a smooth and engaging checkout experience for players.

"Fluid is poised to raise the bar for what we expect from a digital wallet/cashier solution creating a fully user-centric experience and setting new benchmarks for efficiency and security. We are proud to be a part of this journey."

Robin Reed, Managing Partner at Aurora

Fluid’s mobile-first approach ensures top-notch performance across devices, catering to players who expect speed and reliability. By supporting multiple currencies and cryptocurrencies, it addresses the needs of a diverse audience without compromising security or transaction speed.

As the iGaming landscape evolves, Fluid remains committed to pushing boundaries. The future of payment processing in the industry lies in continuous improvement and openness. Fluid’s flexible platform turns payment processing into a strategic advantage for Malta-based operators. By tackling the regulatory challenges and operational demands unique to the Maltese iGaming sector, Fluid offers a clear path forward for operators focused on enhancing player satisfaction and streamlining operations.

FAQs

How does Fluid's AI-driven payment flow improve the payment experience?

Fluid's AI-powered payment system takes the payment process to a whole new level by delivering real-time personalisation and flexible interfaces. It has the ability to detect moments of hesitation or potential issues during a transaction and immediately adapts the process, making payments quicker, easier, and more user-friendly.

By customising every step to match the user's preferences, this smart system dramatically cuts down on friction and reduces the chances of payment abandonment. The outcome? A smooth, efficient experience that meets the high-speed demands of the iGaming world, benefiting both operators and players alike.

How does Fluid make the integration process so fast and efficient?

Fluid makes integration simple with its highly adaptable WebComponent. With just two lines of JavaScript, operators can have the system fully operational in mere minutes. Businesses can fine-tune payment methods and customise themes in less than a day, offering the flexibility to meet their specific requirements. This streamlined approach not only saves valuable time but also ensures a smooth and hassle-free experience for users.

How does Fluid prioritise security while maintaining a smooth user experience?

Fluid prioritises keeping your data safe while making sure the platform remains easy to use. It employs encryption, tokenisation, and multi-factor authentication to safeguard your information around the clock. On top of that, AI-driven fraud detection tools and frequent audits work tirelessly to keep transactions secure.

What’s great is that these security measures are built right into the platform, allowing users to make payments effortlessly without sacrificing security.