iGaming Payment Systems Explained: From Integration to Optimization

Dec 26, 2025

Fluid

How iGaming payment systems work: integration methods, Malta AML/KYC requirements, AI-driven fraud prevention, and performance optimization for better conversions.

iGaming payment systems are the core of online gaming platforms, managing deposits, withdrawals, fraud prevention, and regulatory compliance. Here's what you need to know:

Smooth payment processes keep players engaged, while delays or errors can lead to revenue loss.

AI-driven tools are transforming payments by personalising methods and improving fraud detection.

Malta-licensed operators must follow strict AML, KYC, and GDPR rules, including euro (€) transactions and local data formats.

Key metrics like payment success rates, processing speed, and fraud detection rates help operators improve performance.

Emerging trends like cryptocurrencies, open banking, and instant payouts are reshaping the industry.

The takeaway: Secure, efficient, and compliant payment systems are essential for building trust and driving growth in the competitive iGaming market.

How Payment Tech Will Drive iGaming Growth

Core Components of iGaming Payment Systems

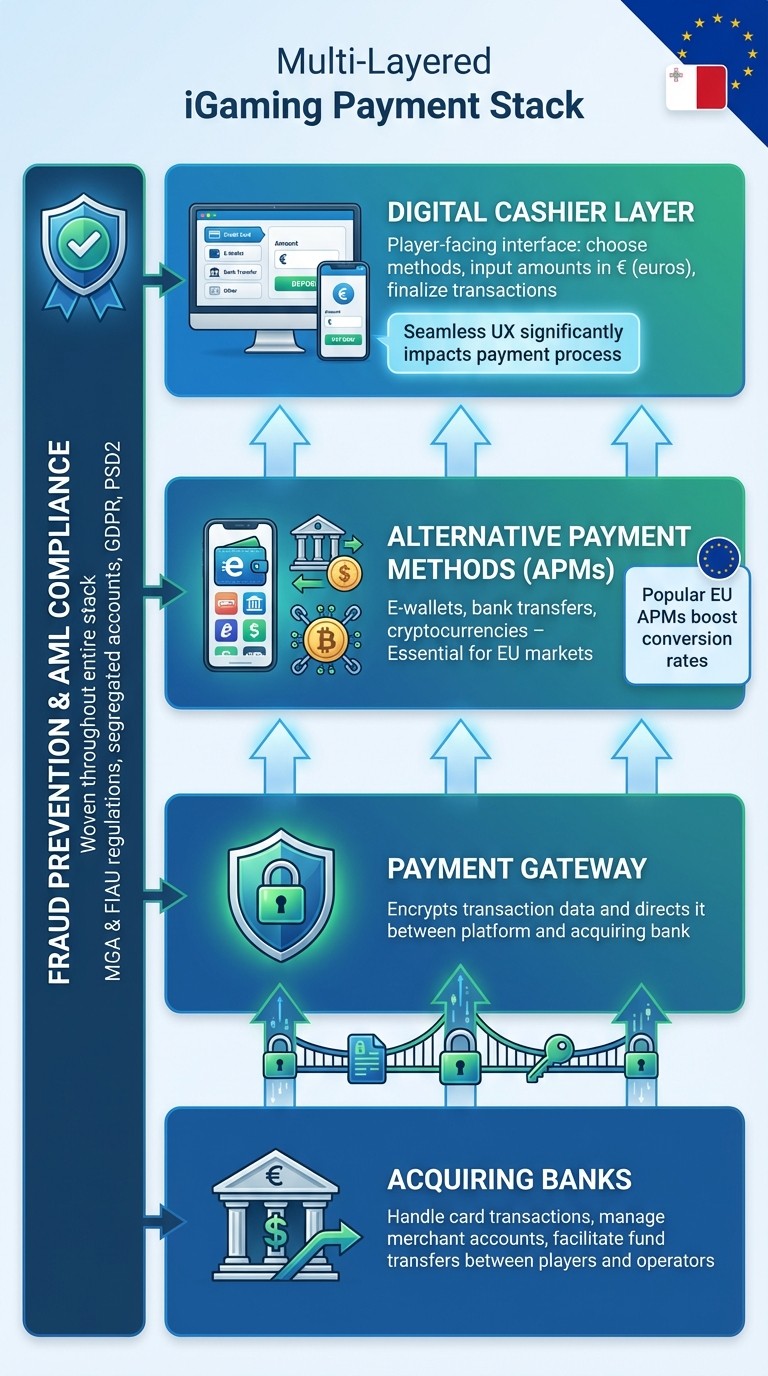

iGaming Payment Stack Architecture: 4-Layer System Explained

The Payment Stack Explained

iGaming payment systems rely on a multi-layered structure where each component plays a specific role. At the base, acquiring banks handle card transactions, manage merchant accounts, and facilitate the transfer of funds between players and operators. A payment gateway acts as the secure bridge, encrypting transaction data and directing it between your platform and the acquiring bank.

To cater to diverse player preferences, Alternative Payment Methods (APMs), such as e-wallets, bank transfers, and cryptocurrencies, are indispensable. For Malta-licensed operators targeting European markets, offering popular EU APMs is key to boosting conversion rates. The digital cashier layer is the player-facing interface where users choose payment methods, input amounts in euros (€), and finalise transactions. A seamless and intuitive user experience here can significantly impact the payment process.

Fraud Prevention and AML Compliance

Fraud prevention and Anti-Money Laundering (AML) compliance are woven throughout the payment stack. Operators must adhere to the regulations set by the Malta Gaming Authority (MGA) and the Financial Intelligence Analysis Unit (FIAU), which include maintaining segregated player accounts, enforcing AML protocols, and safeguarding data under GDPR.

The technical infrastructure supporting these systems must meet stringent standards. For instance, critical servers housing player and financial data need to be located within Malta, another EEA country, or a jurisdiction approved by the MGA. This ensures data security and facilitates regulatory oversight. Payment Service Providers (PSPs) are instrumental in delivering secure, integrated services that comply with AML and anti-fraud regulations. Additionally, the EU's Revised Payment Services Directive (PSD2) bolsters consumer protection, making payments more secure while encouraging technological progress.

AI-powered analytics further enhance fraud detection by monitoring player behaviour in real time, flagging suspicious activities before they escalate. This not only supports compliance but also transforms regulatory obligations into an operational advantage, enabling faster and safer transactions. By leveraging these advanced tools, Fluid takes the payment experience to the next level for both operators and players.

How Fluid Improves the Payment Journey

Fluid, an AI-driven digital cashier, redefines the payment experience by offering personalised solutions, step-by-step guidance, and robust fraud prevention. Instead of presenting a generic array of payment options, Fluid analyses user behaviour - such as transaction history, preferred methods, deposit amounts, and device usage - to simplify each step of the process.

Payment Integration for iGaming Operators

Technical Integration Methods

Today's payment systems rely heavily on API-based connections, enabling instant communication with payment providers. These RESTful APIs handle everything from starting a transaction to processing refunds. Webhooks play a crucial role by sending real-time updates on payment statuses to your system. For both mobile and web platforms, it's essential that front-end components are responsive, ensuring a smooth user experience. A well-designed, integrated payment flow makes the journey from game selection to deposit confirmation effortless.

Additionally, your system must adhere to Malta and EU data standards to guarantee seamless integration and compliance.

Localised Data Formats for Malta and the EU

Once the API integration is in place, adapting to local data formats is key for compliance and user satisfaction. For European standards, monetary values should include the € symbol, display thousands with commas, and use dots for decimals. Dates should follow the DD/MM/YYYY format. To enhance efficiency, work with payment providers that support SEPA Instant Transfers and TARGET2 systems.

Before launching, conduct thorough compliance testing to ensure proper localisation. This includes checking number formats, translations, and adherence to regional tax regulations. Not only does this prevent compliance issues, but it also improves user trust and conversion rates.

Compliance-Driven Payment Flows

Secure and compliant transaction logging is the backbone of a reliable payment system. Automatically record key details like player IDs, transaction amounts, timestamps, and payment methods. This detailed logging feeds into monitoring systems designed to detect unusual activity, such as potential fraud or money laundering. Automating checks for AML (Anti-Money Laundering) and KYC (Know Your Customer) standards strengthens both security and regulatory compliance. These measures not only protect transactions but also build player confidence in your platform.

Optimising Payment Performance and Player Experience

Key Payment KPIs for iGaming Operators

To understand and improve payment performance, tracking specific metrics is essential. Start with the payment success rate, which shows the percentage of transactions completed successfully. Then, consider payment processing speed - how quickly deposits and withdrawals are handled. Keeping an eye on the chargeback frequency helps you spot disputed transactions early, while the deposit completion rate highlights how many initiated deposits are finalised.

Other critical metrics include the fraud detection rate, which measures how effectively your system identifies suspicious activity, and the AML alert rate, which monitors potentially risky transactions. The KYC completion rate reflects how smoothly identity verification works during onboarding. Additionally, metrics like revenue per player (ARPU) and the new player deposit rate provide insights into player conversion. It’s worth noting that 52% of U.S. bettors faced declined payments during signup, with 17% choosing to leave permanently.

These KPIs align with Fluid's focus on seamless integration and robust security, ensuring a reliable payment experience for both operators and players.

AI-Driven Personalisation and Conversion Optimisation

Modern payment systems now adapt to player preferences in real time. Fluid's AI examines user behaviour, such as time spent on deposit pages, method changes, and abandonment points, to suggest the most suitable payment options. This tailored approach reduces friction, keeping players engaged and enhancing their overall experience.

To meet diverse customer needs, embedded payments and an optimised user experience are crucial. Offering a variety of region-specific payment methods - like PayPal, Trustly, or mobile wallets - alongside traditional credit cards can significantly boost customer loyalty. Features like saved card details for future transactions and support for local currencies further streamline the process, directly improving conversion rates.

These personalised payment flows are complemented by advanced fraud controls, ensuring that every transaction is both smooth and secure.

Fraud and AML Risk Management

AI and machine learning are at the heart of modern fraud and AML management. These tools use sophisticated risk scoring to evaluate transactions in real time, applying velocity rules that flag unusual patterns, such as unexpected transaction amounts or frequencies. This level of monitoring is specifically tailored to meet iGaming compliance requirements, ensuring adherence to MGA standards while protecting both your platform and your players.

Automated checks seamlessly integrate into your payment process, performing AML and KYC verifications without disrupting legitimate transactions. By balancing security with a frictionless user experience, your platform remains compliant while delivering the smooth payment journey players expect.

Governance, Compliance, and Future Trends

Keeping Up with Regulatory Changes

The Malta Gaming Authority (MGA) has long been recognised for setting high standards in regulatory oversight, shaping how iGaming operators manage payments. Alongside the Financial Intelligence Analysis Unit (FIAU), which enforces anti-money laundering (AML) and Counter-Financing of Terrorism (CFT) compliance, Malta's regulatory framework demands constant vigilance and adaptability from operators.

Failing to comply with these regulations can lead to severe consequences, including hefty fines, the loss of operating licences, or even exclusion from the market. Customer support teams also play a pivotal role in compliance, acting as trusted points of contact during sensitive interactions. Operators must consistently update their compliance strategies to keep pace with evolving regulatory requirements and supervisory expectations. These ongoing adaptations lay the groundwork for the transformative trends reshaping iGaming payments.

Emerging Trends in iGaming Payments

The iGaming industry is undergoing a period of rapid transformation. Cryptocurrencies, open-banking systems, and the growing demand for instant payouts are changing the way players interact with payment platforms. Payment systems have become a key growth driver, enhancing player conversion rates, retention, and overall satisfaction.

Fintech is at the forefront of this evolution. AI-driven cashiers are becoming increasingly common, offering personalised experiences tailored to regional preferences and rising user expectations. The shift toward a customer-first approach is blurring the lines between different payment channels, with flexibility emerging as a critical competitive edge. Open banking, in particular, is creating new opportunities for operators to simplify deposits and withdrawals while maintaining robust security. Players now expect seamless, instant transactions as the baseline standard.

Staying Ahead of the Curve

As these trends take hold, aligning technological advancements with regulatory compliance becomes essential. Building on strategies that prioritise integration and optimisation, future-ready systems must strike a balance between innovation and adherence to strict regulatory requirements.

Operators should ensure their infrastructure can adapt to changing regulations and accommodate new payment methods like cryptocurrencies and open banking. Solutions like Fluid’s AI-powered platform enable rapid integration with minimal development effort, supporting multiple currencies and cryptocurrencies. This positions operators to thrive in an ever-evolving iGaming payments landscape, keeping them ahead of the curve as the industry continues to innovate.

Conclusion

iGaming payment systems are the backbone of successful platforms, ensuring transactions are secure and efficient. Every step of the payment process matters - whether it’s choosing the right technical solutions, meeting Malta’s strict regulatory requirements, or using AI tools to deliver personalised player experiences.

Staying compliant is not just a box to tick; it’s a necessity. Malta’s rigorous regulations are designed to protect both operators and players, and failing to meet these standards can lead to serious consequences. Trust is built by consistently adhering to these frameworks, which benefits both the platform and its users.

But compliance alone isn’t enough. Improving payment systems is key to driving growth. By keeping an eye on metrics like conversion rates, transaction success rates, and processing times, operators can uncover ways to boost player satisfaction and increase revenue. AI tools add another layer of efficiency by analysing user behaviour in real time, spotting fraud patterns, and customising payment options to suit individual needs.

As the payments landscape evolves, innovation remains crucial. Cryptocurrencies, open banking, and instant payouts are transforming what players expect. Meanwhile, fintech advancements are blending traditional and modern payment methods. Operators that invest in adaptable, forward-thinking infrastructure - capable of meeting new regulations and embracing emerging technologies - will stay ahead in this competitive market.

FAQs

How can AI tools improve fraud detection in iGaming payment systems?

AI tools play a crucial role in boosting fraud detection within iGaming payment systems. By leveraging advanced machine learning algorithms, they can analyse transactions in real-time, spotting unusual patterns or behaviours that might indicate fraudulent activity. This proactive approach helps tackle issues before they spiral out of control.

With automated risk assessments and adaptable fraud prevention strategies, AI helps combat threats like chargebacks and unauthorised transactions. At the same time, these tools ensure transactions are processed quickly while adhering to strict security protocols, such as PCI-DSS. This balance provides a secure yet smooth experience for players.

What advantages do cryptocurrencies and open banking offer for iGaming payments?

Cryptocurrencies offer a way to make quick, borderless payments with lower fees and added privacy. This appeals to both players and operators by cutting out intermediaries, ensuring a smoother and more efficient payment process.

Meanwhile, open banking allows for secure, direct bank-to-bank transfers, sidestepping traditional card networks. This approach speeds up transaction times, lowers costs, and increases success rates. Both methods elevate the user experience and streamline payment processes in the iGaming sector.

Why is it important for iGaming operators in Malta to comply with local regulations?

Compliance with Malta's regulatory standards is a must for iGaming operators. It not only ensures they meet legal obligations but also helps build player trust and keeps the licensing process running smoothly. These standards are designed to encourage responsible gaming, protect player data, and shield operators from fines or legal troubles.

By following these regulations, operators show their dedication to providing a safe and open environment. This commitment not only boosts their reputation in the highly competitive iGaming sector but also plays a big role in improving player satisfaction.